AI Alone Won’t Drive Revenue — But This Architecture Will

How AI drives revenue is one of the most searched questions in business strategy right now — and most answers get it wrong.

Here is the short version:

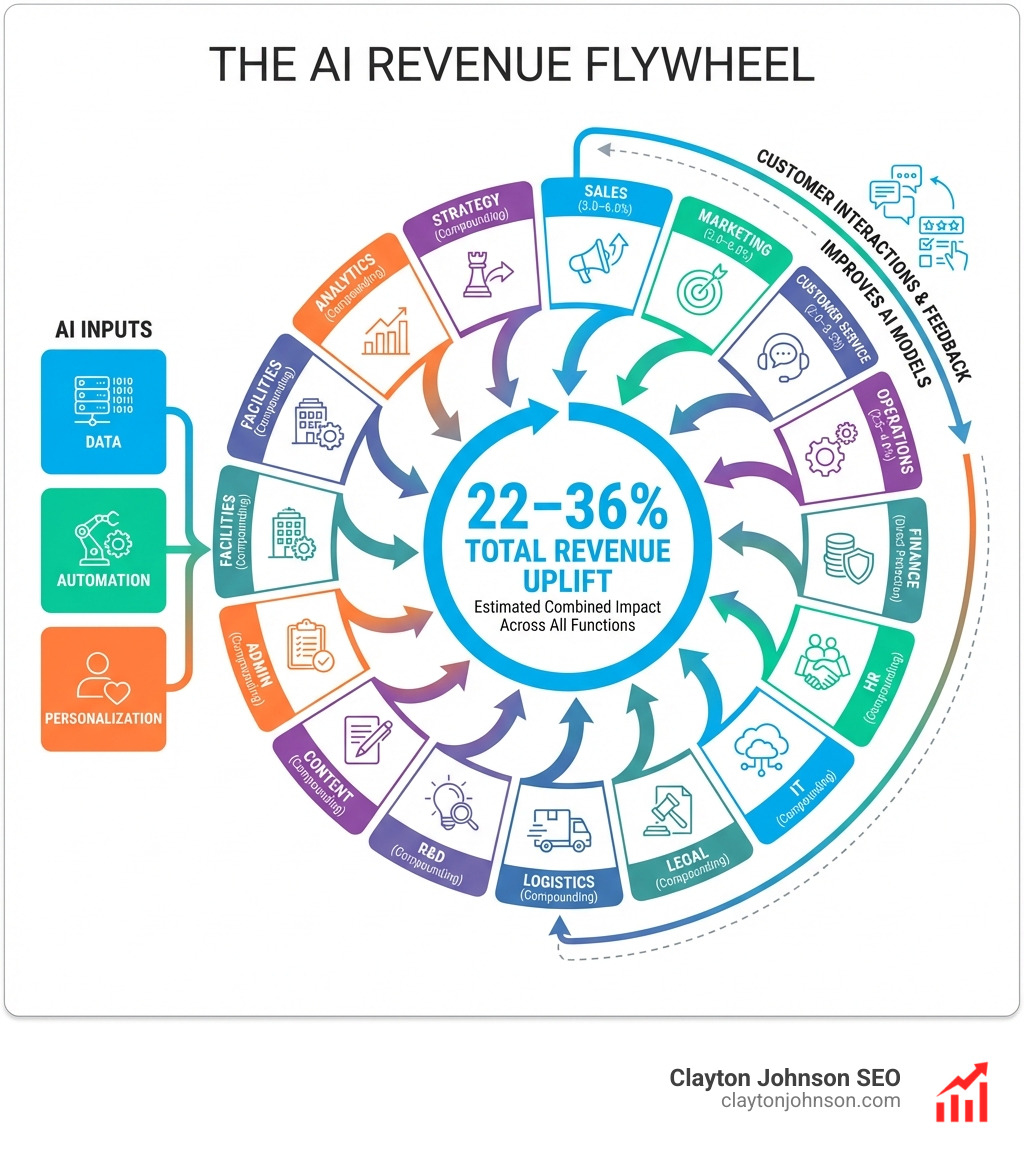

AI drives revenue by transforming every business function into a growth engine — not just cutting costs.

| Function | AI Revenue Mechanism | Estimated Uplift (on $100M baseline) |

|---|---|---|

| Sales & Marketing | Hyper-personalization, lead scoring, dynamic pricing | 3.0–6.0% ($3–6M) |

| Customer Service | Churn prediction, conversational upsells, premium tiers | 2.0–3.5% ($2–3.5M) |

| Operations & Manufacturing | Predictive maintenance, zero-defect quality, throughput | 2.5–4.0% ($2.5–4M) |

| Finance & Accounting | Predictive cash flow, fraud prevention, margin intelligence | Direct revenue protection |

| HR, Legal, IT, Logistics | Upskilling, contract speed, downtime avoidance, last-mile routing | Compounding across functions |

| Total Combined Uplift | All 15 business functions | 22–36% ($22–36M) |

Most businesses use AI tactically. They automate a task here, generate content there. The results are modest because the approach is fragmented.

The companies seeing real revenue gains — like Amazon, which delivered nearly $60 billion in net income boosted by AI efficiencies and AWS AI sales — treat AI as strategic infrastructure, not a productivity shortcut.

That distinction matters more than any individual AI tool you deploy.

The gap between AI as a tactic and AI as a growth system is where most founders and marketing leaders get stuck. Nearly half of organizations cite the lack of a clear AI strategy as their biggest implementation barrier. The problem is not the technology. It is the architecture around it.

I’m Clayton Johnson, an SEO and growth strategist who has spent years building AI-augmented marketing systems and measurable growth frameworks — work that sits directly at the intersection of how AI drives revenue and how strategy converts into compounding results. In the sections below, I’ll break down exactly how AI creates revenue across every major business function, and what separates the companies that capture that value from those still running pilots.

Discover more about How AI drives revenue:

The Architecture of Growth: How AI Drives Revenue Beyond Efficiency

When we look at the numbers, the potential for revenue uplift isn’t just a marginal gain; it’s a fundamental shift in the business baseline. Research suggests that across a $100M baseline, the combined AI revenue opportunity is estimated at 22–36%. That’s an additional $22M to $36M annually that stays on the table if your AI strategy is limited to “writing emails faster.”

The problem is that many leaders are playing defense. They see AI as a way to trim the fat. But the winners are playing offense. They are building a “digital core”—a unified foundation of cloud, data, and AI—that accelerates revenue by 20% compared to peers. This isn’t just about efficiency; it’s about a multiplier effect where every dollar invested in AI infrastructure compounds across the organization.

However, a survey conducted by McKinsey & Company showed that the most common challenge in implementing AI solutions is the lack of a clear AI strategy (43%). Without a structured growth framework, AI becomes a series of expensive “cool projects” that never move the needle on the P&L.

How AI drives revenue in Sales and Marketing

In Sales and Marketing, AI is the ultimate force multiplier. We’ve seen that businesses effectively deploying AI in these areas can see revenue increases of 10% or more. This happens through three primary levers:

- Hyper-Personalization at Scale: AI doesn’t just put a first name in a subject line. It analyzes millions of data points to deliver the “next-best-action” for a specific customer in real-time. This can lift conversion rates by 8–15%.

- AI Lead Scoring & Pipeline Prioritization: Instead of sales reps chasing every lead, AI identifies which prospects have the highest intent. This focus can double actual selling time and increase win rates by over 30%.

- Dynamic Pricing & Lifecycle Orchestration: By adjusting offers based on real-time market demand and individual customer value, companies can optimize margins without losing volume.

How AI drives revenue through Product R&D

Product development is often a high-risk, high-cost gamble. Historically, only 30–40% of new products succeed. AI changes the math by doubling those success rates through better targeting and faster iteration.

By using “digital twins”—virtual replicas of products or processes—companies can simulate thousands of stress tests and usage scenarios before a single physical prototype is built. In industries like pharmaceuticals, this has accelerated drug development cycles from 48 months down to just 12. For consumer goods, it can cut development time to one-third of the industry average. This speed-to-market doesn’t just save costs; it captures market share that competitors haven’t even targeted yet.

Turning Cost Centers into Profit Engines: Functional Transformation

The most radical way how AI drives revenue is by flipping the script on traditional “cost centers.” Take customer service. Traditionally, every call to support was a drain on resources. With AI, customer service becomes a profit engine.

AI-driven churn prediction models can flag at-risk customers with over 80% precision. When an AI detects a customer’s usage is declining or their tone is frustrated, it can trigger a proactive “retention save” offer within 24 hours. Furthermore, “conversational commerce” allows AI agents to identify buying cues during a support interaction—like a customer asking for more storage—and seamlessly transition them into a premium tier upgrade.

| Traditional Cost Center | AI-Augmented Profit Center | Revenue Impact |

|---|---|---|

| Customer Support | Proactive Retention & In-thread Upsells | 2.0–3.5% Uplift |

| Finance | Predictive Cash Flow & Margin Intelligence | Reinvestment Gains |

| Legal | Accelerated Contract-to-Cash | Faster Sales Cycles |

| Operations | Predictive Maintenance & Yield Optimization | 2.5–4.0% Uplift |

Monetizing the Back Office

Even functions like Finance, HR, and Legal—areas usually viewed as overhead—can directly contribute to the top line.

- Finance: AI enables “Dynamic Margin Intelligence,” providing real-time profitability models that help leaders decide where to double down and where to cut back. Predictive cash flow optimization allows for faster reinvestment of capital into growth initiatives.

- Legal: AI drafting and clause checking can accelerate contract closure by days or weeks. In a high-velocity sales environment, shortening the “contract-to-cash” cycle is a direct revenue win.

- HR: AI-upskilling engines create internal talent capabilities that would otherwise cost millions to hire externally. By predicting attrition, HR can intervene before high-value “revenue-producers” leave the company.

Operational Intelligence and Supply Chain

In manufacturing and logistics, AI drives revenue by maximizing throughput and eliminating “revenue leaks.” Predictive maintenance ensures that machinery stays running; every 1% increase in uptime for a large firm can equate to millions in recovered sales.

In the supply chain, AI prevents stockouts (which typically cost 2–4% of lost sales) via hyper-accurate demand forecasting. Logistics becomes a conversion driver when AI-optimized last-mile routing allows a company to offer premium same-day or next-day delivery tiers.

From Generative to Agentic: The Next Frontier of Revenue Orchestration

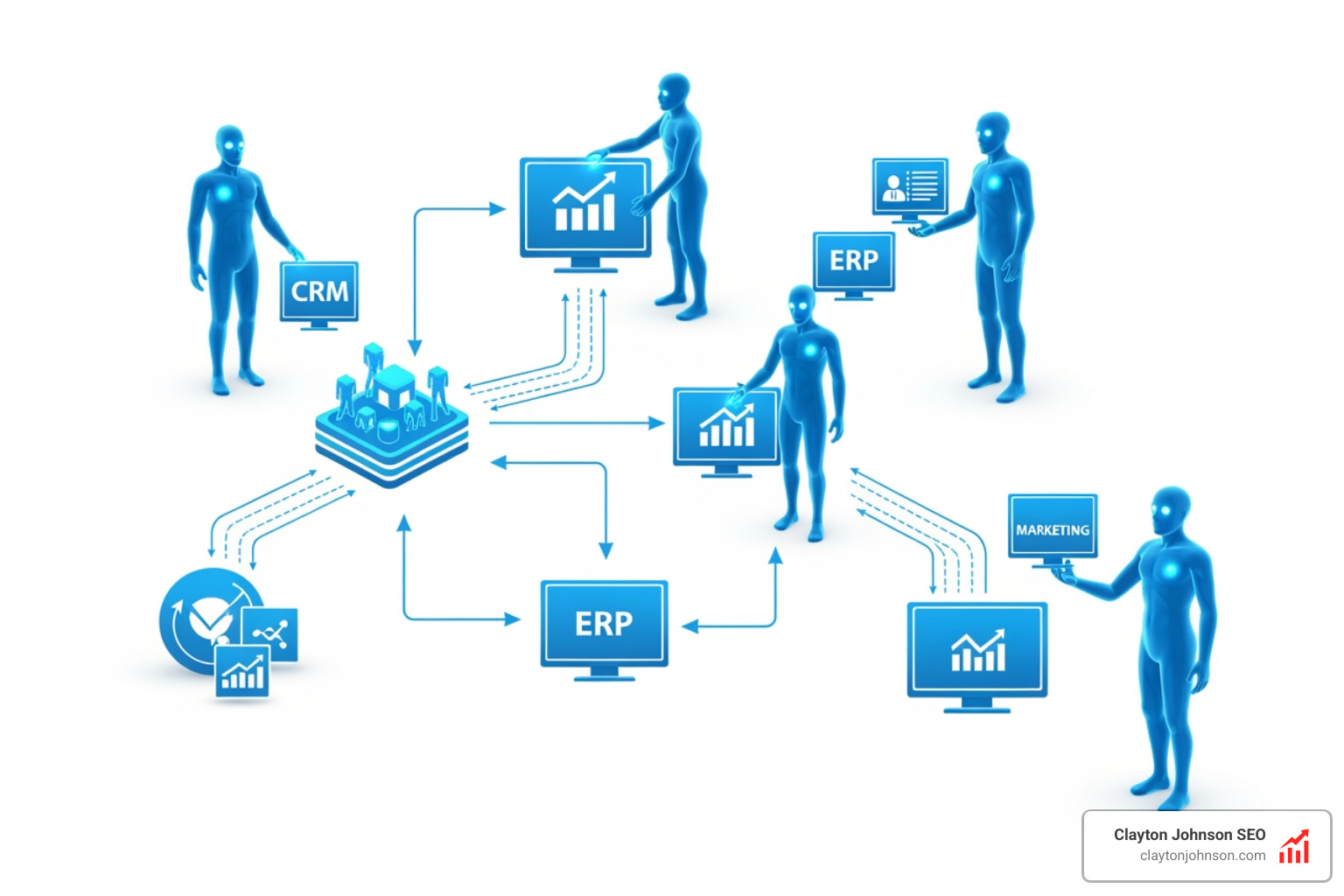

We are currently moving past the era of “GenAI as an assistant” and into the era of Agentic AI. While traditional AI might help you write a report, Agentic AI acts as a self-directed agent that can plan, execute, and learn with minimal human input.

This is “revenue orchestration” at its finest. These agents don’t just flag a risk; they coordinate across departments to solve it. For example, an agentic system might notice a supply delay, automatically update the marketing spend to prioritize in-stock items, and notify the sales team to pivot their outreach—all in real-time.

Scaling with Minimal Human Intervention

The beauty of these systems is the “virtuous feedback loop.” As AI makes decisions—like choosing a specific ad variant or a pricing model—it monitors the customer response. It then feeds that data back into the objective function to improve the next decision. This macro-to-micro optimization allows a business to scale its revenue strategy without needing to scale its headcount at the same rate.

Consider the scale of tech giants. AWS reached a $115 billion annual revenue run rate recently, driven largely by the massive demand for AI infrastructure. They aren’t just selling a tool; they are selling the “monetizable compute” that allows other businesses to build their own AI revenue streams.

The CIO as a Revenue Architect

This shift is fundamentally changing the C-suite. The CIO is no longer just the “IT person”; they are becoming a Revenue Architect. By sitting at the intersection of technology, data, and revenue, the CIO partners with the CRO to build the systems that drive predictable growth.

They use “decision simulations”—essentially a digital twin of the entire business—to ask, “If we enter this new market with this pricing strategy, what is the projected impact on our SKU portfolio?” This level of strategic precision was impossible just a few years ago.

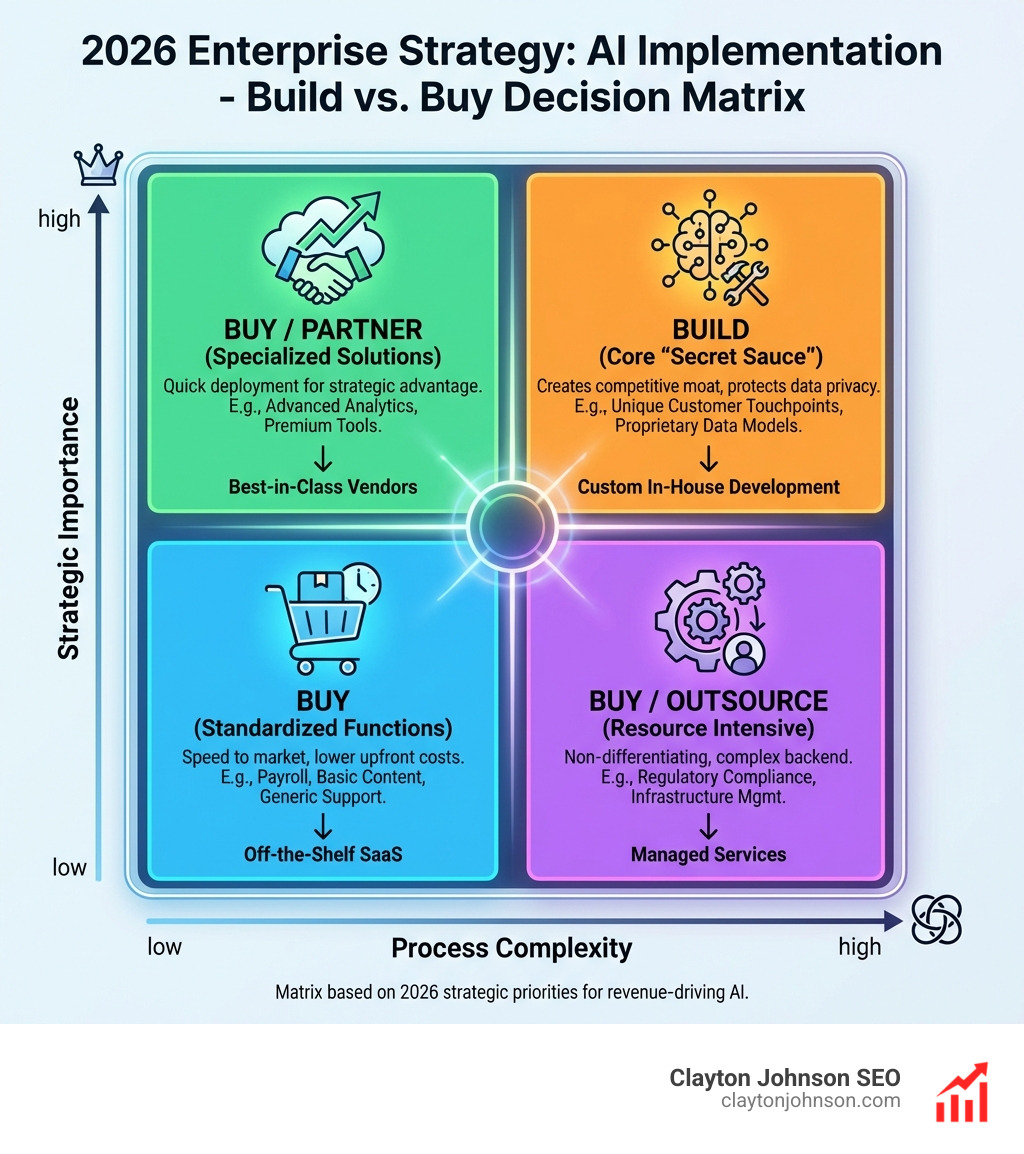

Strategic Implementation: Navigating the Build vs. Buy Dilemma

One of the most frequent questions we hear is: “Should we build our own AI or buy an existing solution?” The answer depends on where you seek your competitive advantage.

- Buy: Use existing SaaS AI tools for standardized functions like payroll, basic content drafting, or generic customer support. This offers speed to market and lower upfront costs. More info about AI tools can help you identify which off-the-shelf solutions are worth the investment.

- Build: Invest in custom AI for the core “secret sauce” of your business—the parts that directly touch your customers or your unique operational data. This protects your data privacy and creates a moat that competitors can’t easily replicate.

However, the “talent gap” remains a significant barrier. While up to 300 million jobs could be impacted by AI, the real risk isn’t job loss—it’s the lack of people who know how to architect these systems.

Success Factors for Scalable Performance

To move from a pilot to a payoff, we focus on several key success factors:

- Data Hygiene: AI is only as good as the data it consumes. Successful companies often eliminate up to 80% of old or inaccurate data to ensure their models aren’t hallucinating on bad information.

- C-Level Sponsorship: AI transformation is too big for a single department. It requires an “AI Council” of cross-functional leaders.

- Process Redesign: You cannot simply automate an inefficient process and expect a revenue miracle. You must reimagine the workflow for an AI-first world.

- Human-in-the-Loop: Especially for high-value decisions, maintaining human oversight ensures ethical alignment and prevents “algorithmic drift.”

Frequently Asked Questions about AI Revenue Impact

How does AI transform customer service into a revenue generator?

AI transforms service by moving from reactive “ticket solving” to proactive “value creation.” It uses churn prediction to save customers before they leave, conversational AI to identify upsell opportunities during support chats, and enables premium “AI-powered” support tiers that customers are willing to pay for.

What are the biggest challenges to realizing AI-driven revenue gains?

The biggest barriers are the lack of a clear AI strategy (43% of firms), poor data quality, and a shortage of specialized talent. Many companies also fail because they try to automate existing, broken processes rather than redesigning them for AI.

Can AI in HR and Finance directly contribute to the top line?

Yes. Finance contributes via predictive cash flow (more capital for growth) and margin intelligence. HR contributes by reducing the massive costs of attrition through predictive modeling and by using AI-upskilling to create high-value internal capabilities that drive revenue throughput.

Conclusion

At the end of the day, how AI drives revenue is a question of architecture. Tactics are easy to copy; a structured growth operating system is not.

At Demandflow, we believe that most companies don’t lack the “will” to grow—they lack the infrastructure. We build the SEO strategies, content architectures, and AI-augmented workflows that turn “AI potential” into “compounding revenue.” Whether it’s through authority-building ecosystems or measurable growth modeling, the goal is always the same: Clarity, Structure, Leverage, and Growth.

AI is the most powerful engine we’ve ever seen, but an engine without a chassis and a steering wheel is just a loud noise. Build the architecture first.