How to Build an EVA Scorecard Without Breaking the Bank

The Essential EVA Scorecard Design Guide for Modern Governance

An EVA scorecard design guide helps you build a powerful tool for project and strategic management. This tool combines Earned Value Analysis (EVA) with a scorecard approach. It gives you clear insights into project health and strategic alignment.

- What it is: An EVA Scorecard integrates core EVA metrics (Planned Value, Earned Value, Actual Cost) into a comprehensive performance framework.

- Why it matters: It provides real-time visibility into project cost, schedule, and performance. This helps with strategic decision-making and risk management.

- Key benefit: It links day-to-day project operations directly to strategic business outcomes. This drives continuous improvement and corporate governance.

Project managers know the challenge: balancing cost, time, quality, and scope while showing real progress. Traditional financial metrics often fall short. They don’t capture the full picture of value creation or future success. This is where an EVA scorecard design guide becomes essential. It helps you build a system that goes beyond simple numbers. It connects project performance to your company’s bigger goals.

Many organizations struggle with strategy execution. In fact, 9 out of 10 organizations fail to implement their strategies successfully. And companies deliver only 63% of the financial performance their strategies promise. The right measurement tool is critical. It helps bridge the gap between planning and results.

I’m Clayton Johnson, and my expertise lies in building scalable traffic systems and structured strategy frameworks. My work includes helping organizations design and implement effective performance measurement tools like an EVA scorecard design guide for measurable outcomes.

Effective governance isn’t just about making sure people show up to meetings; it’s about ensuring every dollar spent moves the needle toward shareholder value. In modern corporate settings, especially across Minneapolis and the broader Midwest, we see a growing need to merge technical project tracking with high-level financial accountability.

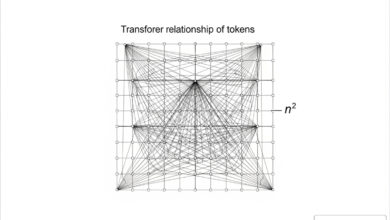

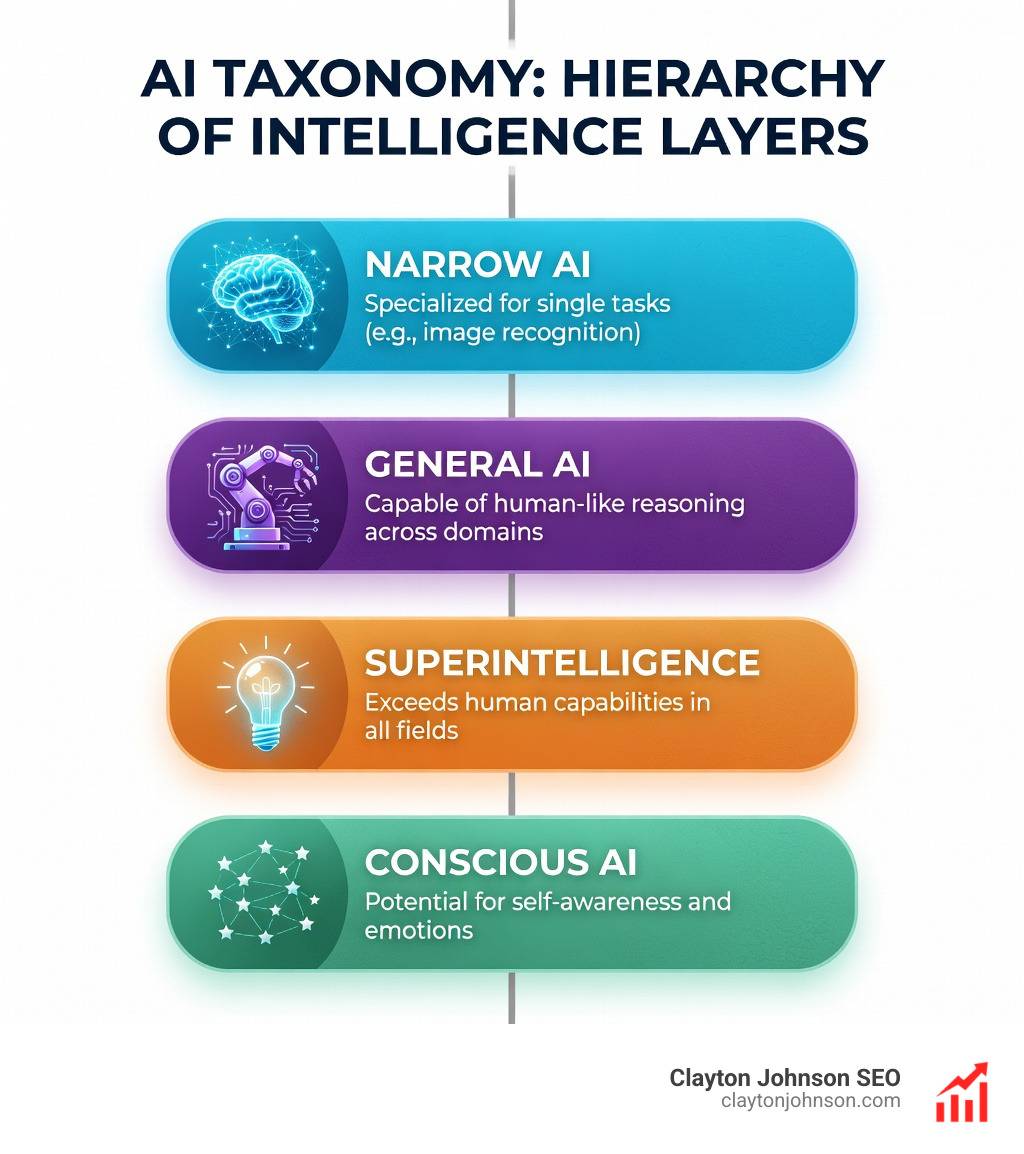

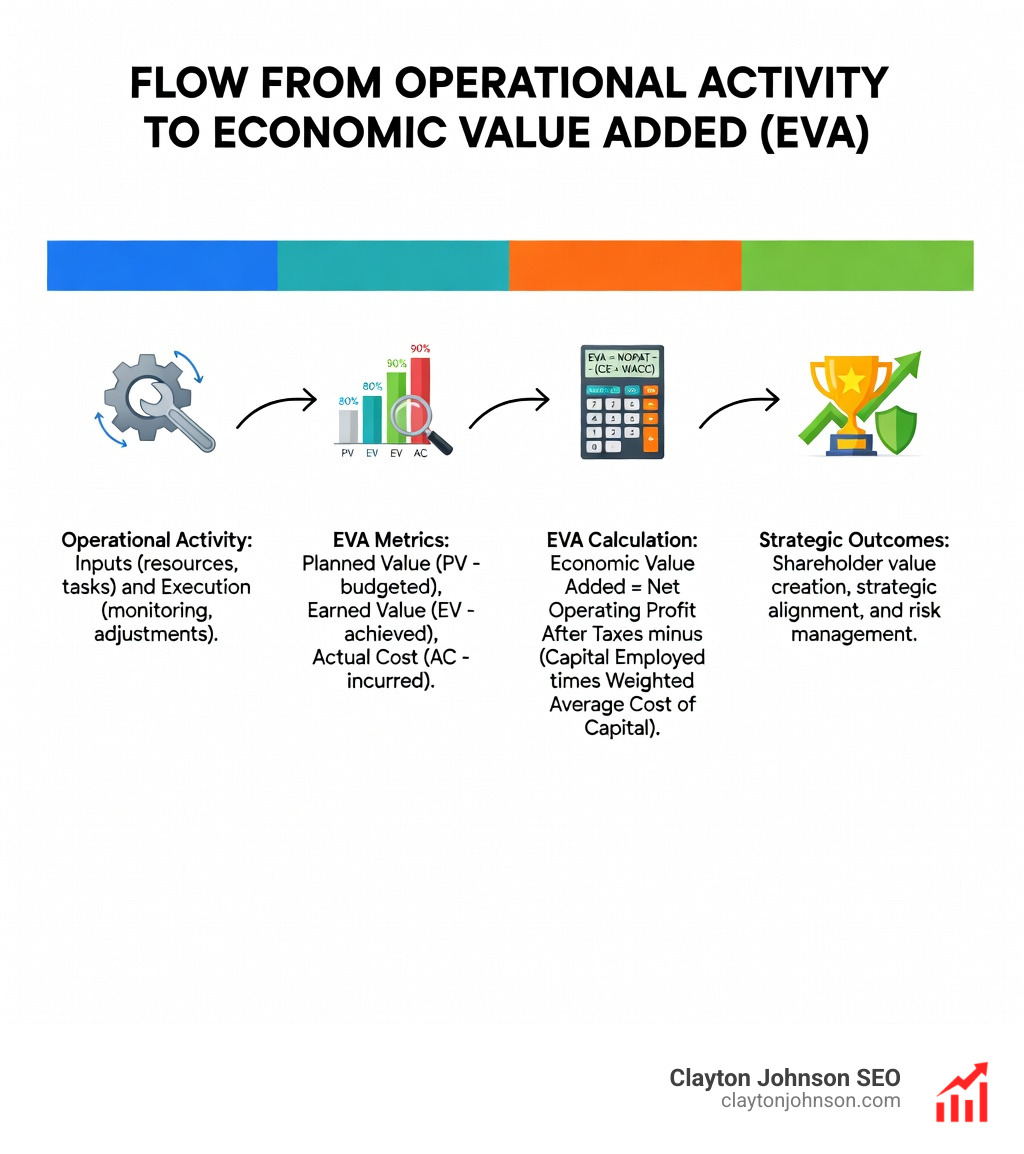

The “EVA” in our EVA scorecard design guide actually serves a dual purpose. In project management, it stands for Earned Value Analysis. In corporate finance, it stands for Economic Value Added. When we combine these, we create a Research on the EVA Integrated Scorecard Performance Measure System that tracks not just if a project is “done,” but if it is actually generating wealth for the organization.

Integrating these concepts allows us to move beyond “gut feelings.” We use strategic design to map out how a specific project task eventually leads to a positive return on capital.

Core Components of Earned Value Analysis

To build your scorecard, you must first master the “Holy Trinity” of project metrics. These form the data foundation of any Earned Value Analysis Sheet:

- Planned Value (PV): Also known as the Budgeted Cost of Work Scheduled (BCWS). This is the authorized budget assigned to scheduled work. It’s what you planned to spend by this point in time.

- Earned Value (EV): The Budgeted Cost of Work Performed (BCWP). This represents the value of the work actually completed. If you finished 50% of a $100 task, your EV is $50, regardless of what you actually spent.

- Actual Cost (AC): The total cost actually incurred in accomplishing the work. This is what your bank account says you spent.

By comparing these three, we can immediately see if we are over budget or behind schedule. It’s like checking your GPS and your fuel gauge at the same time—you need both to know if you’ll actually make it to your destination.

Establishing the Baseline for Your EVA Scorecard Design Guide

You can’t measure progress if you don’t know where you started. Establishing a baseline is the most critical step in this EVA scorecard design guide.

- Work Breakdown Structure (WBS): Break your project into manageable “chunks” or work packages. This allows for granular tracking.

- Performance Thresholds: Decide early on what constitutes a “red flag.” Is a 5% cost overrun acceptable? Or do we sound the alarms at 10%?

- Baseline Establishment: Lock in your scope, schedule, and budget at the start. Without a locked baseline, “scope creep” will render your scorecard useless.

For those looking for a structured approach to setting these up, this Step-by-Step Guide to Creating an Evaluation Scorecard offers a great starting point for defining your criteria.

Essential Metrics for Real-Time Performance Visibility

Once your components are in place, your scorecard needs to translate raw data into actionable insights. We use variances and indices to tell the story of the project.

| Metric | Formula | Interpretation |

|---|---|---|

| Cost Variance (CV) | EV – AC | Positive = Under Budget; Negative = Over Budget |

| Schedule Variance (SV) | EV – PV | Positive = Ahead of Schedule; Negative = Behind Schedule |

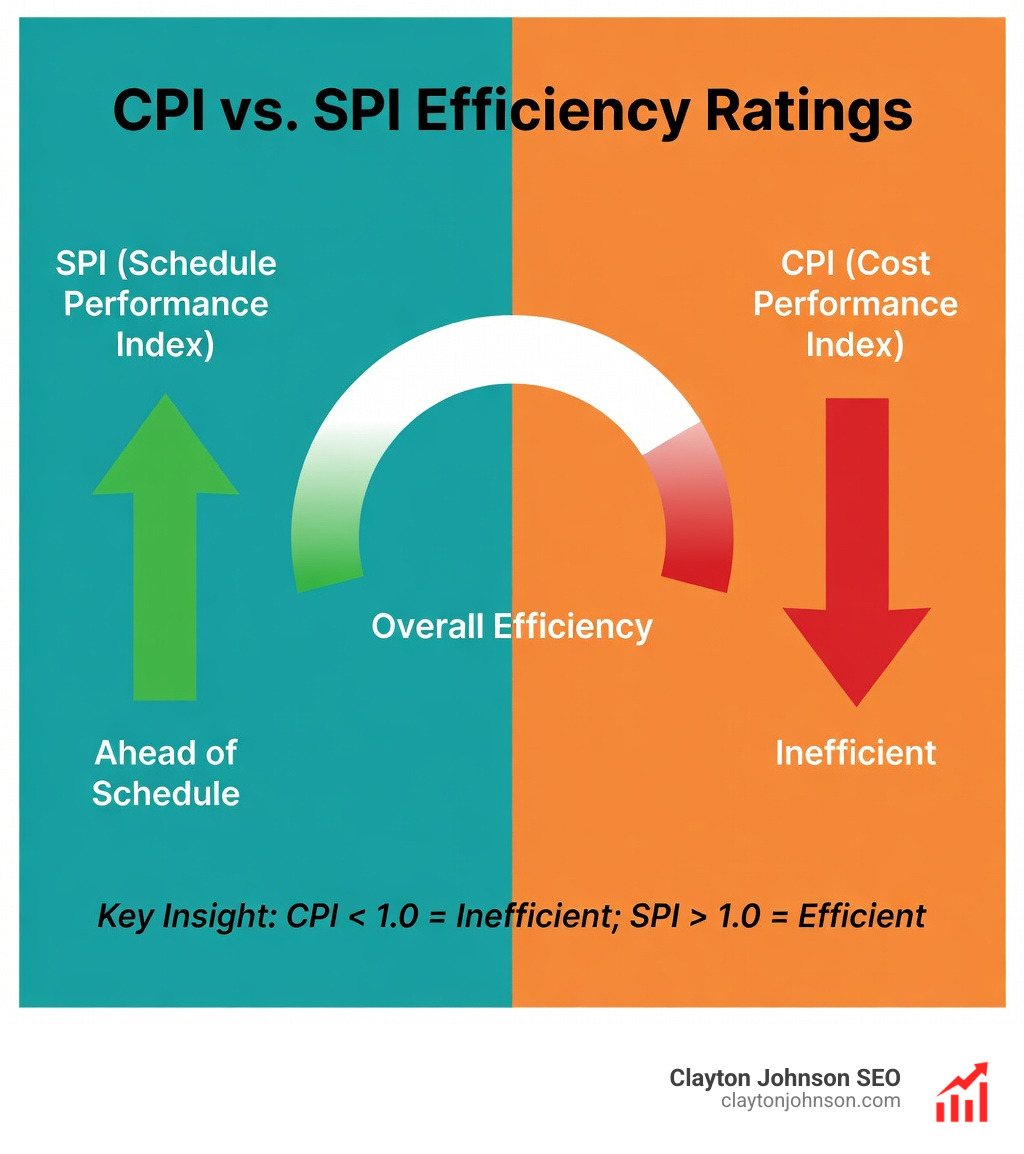

| Cost Performance Index (CPI) | EV / AC | > 1.0 = Efficient; < 1.0 = Inefficient |

| Schedule Performance Index (SPI) | EV / PV | > 1.0 = Efficient; < 1.0 = Inefficient |

The CPI is often considered the most critical metric. If your CPI is 0.8, it means for every dollar you spend, you are only getting 80 cents of value. That’s a leak that needs plugging!

Predictive Control and Forecasting

The real magic of an EVA scorecard design guide isn’t just looking at the past; it’s predicting the future. We use “Estimate at Completion” (EAC) to forecast where the project will land.

- EAC (Estimate at Completion): If we continue at our current efficiency, what will the final bill be?

- VAC (Variance at Completion): The difference between our original budget and our new forecasted EAC.

- BAC Units: Tracking performance in units (like man-hours) rather than just dollars can often provide a clearer picture of operational alignment without the noise of fluctuating material costs.

Establishing Cause-and-Effect Relationships

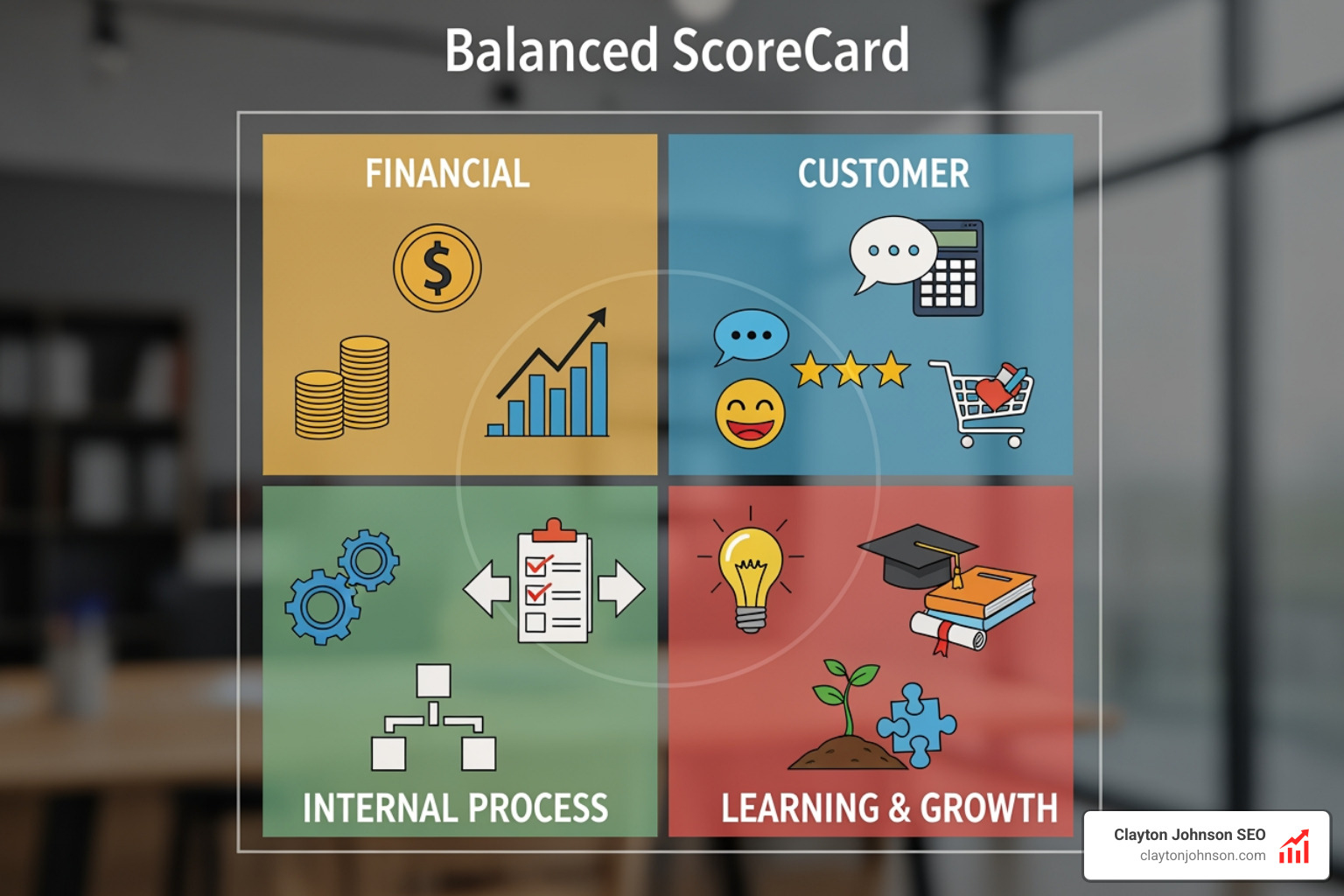

A scorecard shouldn’t just be a list of numbers; it should tell a story. By Combining EVA® with Balanced Scorecard to improve strategic focus and alignment, we can establish “if-then” linkages.

For example: IF we invest in employee training (Learning & Growth), THEN our internal process efficiency will improve (Internal Process), WHICH leads to faster project delivery (Schedule Performance), RESULTING in higher customer satisfaction and better financial returns (Financial).

Integrating EVA into the Balanced Scorecard Framework

The Balanced Scorecard (BSC) is a staple in corporate strategy, with 60% of Fortune 1000 organizations using it. To make your EVA scorecard design guide truly world-class, you should map your EVA metrics across the four standard BSC perspectives:

- Financial Perspective: Use Economic Value Added (the finance version) to see if the project is actually increasing shareholder wealth. Metrics like ROI and Net Present Value live here.

- Customer Perspective: How do our cost and schedule efficiencies affect the client? Are we delivering the value they expected? You can use market analysis to see how your delivery speed compares to competitors.

- Internal Process: This is where Earned Value Analysis (the project version) shines. CPI and SPI are the ultimate measures of how well your internal “project machine” is running.

- Employee Learning & Growth: Are we getting better? If our variances are constantly negative, do we have a skills gap?

Linking Operational Activity to Shareholder Value

Traditional accounting often ignores intangible assets, which now account for roughly 75% of corporate value. An EVA-integrated scorecard helps capture this. When we improve a process or finish a project ahead of schedule, we aren’t just saving money; we are building organizational capability.

As noted in The Balanced Scorecard & EVA, the hybrid approach ensures that the “hard” financial numbers are always balanced by the “soft” drivers of future success.

The Role of the Project Management Office (PMO)

In a Minneapolis-based enterprise, the PMO acts as the “guardian of the data.” They are responsible for:

- Standardization: Ensuring every project uses the same execution roadmaps and EVA formulas.

- Variance Analysis: Not just spotting a problem, but figuring out why it happened.

- Executive Dashboards: Translating complex WBS data into high-level charts that a CEO can understand in 30 seconds.

Overcoming Implementation Barriers and Scaling Performance

Implementing an EVA scorecard design guide isn’t always sunshine and rainbows. You will likely hit a few walls:

- Cultural Resistance: People don’t always like transparency. If a project is failing, the scorecard will show it in bright red. We must foster a culture where “red is an opportunity to improve,” not a reason to fire someone.

- Data Integration: Your financial systems and your project scheduling tools need to talk to each other. If you’re manually typing numbers from Excel into a dashboard, you’re going to have a bad time.

- Complexity: Don’t try to track 500 metrics. Start with the basics (PV, EV, AC) and grow from there. You can use tools like the Ultimate Guide to BMC SWOT Integration Canvas to help simplify your strategic focus.

Scaling Your EVA Scorecard Design Guide for Portfolio Management

When you have 50 projects running at once, you can’t look at every WBS. You need portfolio-level management. An EVA scorecard allows for cross-project comparisons. You can quickly see which projects are “star performers” (High CPI, High SPI) and which are “money pits.”

Using a Performance Evaluation Template helps standardize these evaluations so you’re comparing apples to apples across the whole portfolio.

Enhancing Strategic Decision-Making and Risk Management

The ultimate goal of this EVA scorecard design guide is better decision-making. With real-time visibility, you can:

- Manage Risk: Spot a cost overrun in month two instead of month ten.

- Audit Trails: Maintain a clear record of why certain decisions were made based on performance data.

- Strategic Pivots: If a project’s EAC (Estimate at Completion) suggests it will cost triple the original budget, you might decide to kill the project early and reinvest that capital elsewhere.

A solid SWOT analysis combined with your EVA data can help you decide if a project’s risks are still worth the potential strategic rewards.

Frequently Asked Questions about EVA Scorecards

What is the difference between EVA and traditional financial measures?

Traditional measures (like net income) only look at the past and often ignore the “cost of capital.” EVA (Economic Value Added) considers the opportunity cost of the money tied up in the project. Meanwhile, Earned Value Analysis (the project side) looks at the value of work done, which a standard bank statement can’t tell you.

How does an EVA scorecard improve strategy execution?

It bridges the “Vision Barrier.” Statistics show that only 5% of the workforce understands their company’s strategy. By linking daily tasks to high-level CPI and SPI metrics, employees see exactly how their work contributes to the company’s financial health.

What are the most common challenges when designing an EVA scorecard?

The biggest hurdle is usually “Data Integrity.” If your team isn’t updating their progress (Earned Value) accurately, your metrics will be “garbage in, garbage out.” Another challenge is “Over-Engineering”—trying to track too many things at once. Keep it simple!

Conclusion

Building an EVA scorecard doesn’t have to break the bank, but it does require discipline. By following this EVA scorecard design guide, you can move your organization from reactive firefighting to proactive, strategic management.

At Clayton Johnson SEO, we believe that strategy is nothing without execution. Whether you are optimizing a digital marketing funnel or managing a multi-million dollar infrastructure project in Minneapolis, the principles of balance, measurement, and alignment remain the same.

Ready to dive deeper into the data that drives growth? Check out our analytics and data services to see how we can help you turn complex metrics into a clear path forward. Let’s build a performance culture that actually delivers on its promises.