Why Portfolio Strategy Determines Whether You Win or Lose at Scale

A Portfolio Strategy is the structured system companies and investors use to allocate capital, classify assets, and balance risk across a collection of businesses or investments — with the goal of generating durable, compounding value over time.

Here’s what a strong portfolio strategy covers at a glance:

| Element | What It Means |

|---|---|

| 🏗️ Asset Classification | Grouping business units by role (growth engines, cash cows, fixers) |

| 💰 Capital Allocation | Directing investment where it creates the most value |

| 🔁 Innovation Balance | Splitting focus across core, adjacent, and transformational bets |

| 🛡️ Resilience | Stress-testing the portfolio against scenarios and market shifts |

| 📊 Active Management | Monitoring KPIs, rebalancing, and exiting underperformers |

Most founders and marketing leaders treat portfolio decisions as one-time events. They’re not. They’re ongoing strategic systems.

Research from BCG and Monitor Deloitte consistently shows that the companies outperforming peers aren’t just picking better assets — they’re managing the interactions between those assets more deliberately. One of the most striking examples: a major European chemical company raised its growth rate from the bottom fifth of peers to well above average simply by reclassifying its portfolio and applying smarter reinvestment rules — without increasing total investment.

That’s the leverage a real portfolio strategy creates.

Markets shift. AI is compressing search visibility. Capital gets misallocated. Growth stalls not because the assets are bad — but because the architecture holding them together is broken.

This guide breaks down exactly how to build a portfolio strategy that holds up when conditions get hard.

I’m Clayton Johnson — SEO strategist and growth architect behind frameworks that help founders turn fragmented business units into structured, compounding growth systems. My work in portfolio strategy sits at the intersection of capital allocation, content architecture, and system-level thinking — the same principles that drive durable returns whether you’re managing a business portfolio or a content ecosystem.

Core Pillars of a Resilient Portfolio Strategy

To build a Portfolio Strategy that doesn’t crumble during the first market dip, we have to look past simple stock picking or basic budgeting. We need to view the portfolio as a holistic system. A truly “Advantaged Portfolio” is one where the aggregate value of your holdings is durable over time and significantly greater than the sum of its individual parts.

According to research in Portfolio Management: A Strategic Approach, the goal isn’t just to survive; it’s to create a structure that thrives on adaptation. At Clayton Johnson, we focus on enterprise-strategy/portfolio-strategy/ because we know that without a structured growth architecture, even the best assets eventually stagnate.

The three broad characteristics of a successful portfolio are:

- Strategically Sound: It is weighted toward attractive markets where you actually have a competitive edge.

- Value-Creating: It balances intrinsic value (cash flow and ROIC) with market expectations.

- Resilient: It can survive various future scenarios through optionality and risk assessment.

Defining Your Portfolio Strategy Framework

We start by identifying “Strategically Distinct Businesses” (SDBs). These are units with their own unique competitors, customer bases, and geographic footprints. To evaluate these units, we use three specific lenses:

- Market Perspective: Is the industry structurally attractive? (Think Michael Porter’s Five Forces).

- Financial Perspective: Does the unit generate returns above its cost of capital?

- Ownership Perspective: Are we the “best owner” for this asset, or could someone else extract more value?

By Taking a Portfolio Approach to Growth Investments, we avoid the trap of “democratic allocation,” where every department gets a 3% budget increase regardless of performance. Instead, we move capital to where it has the highest “right to win.”

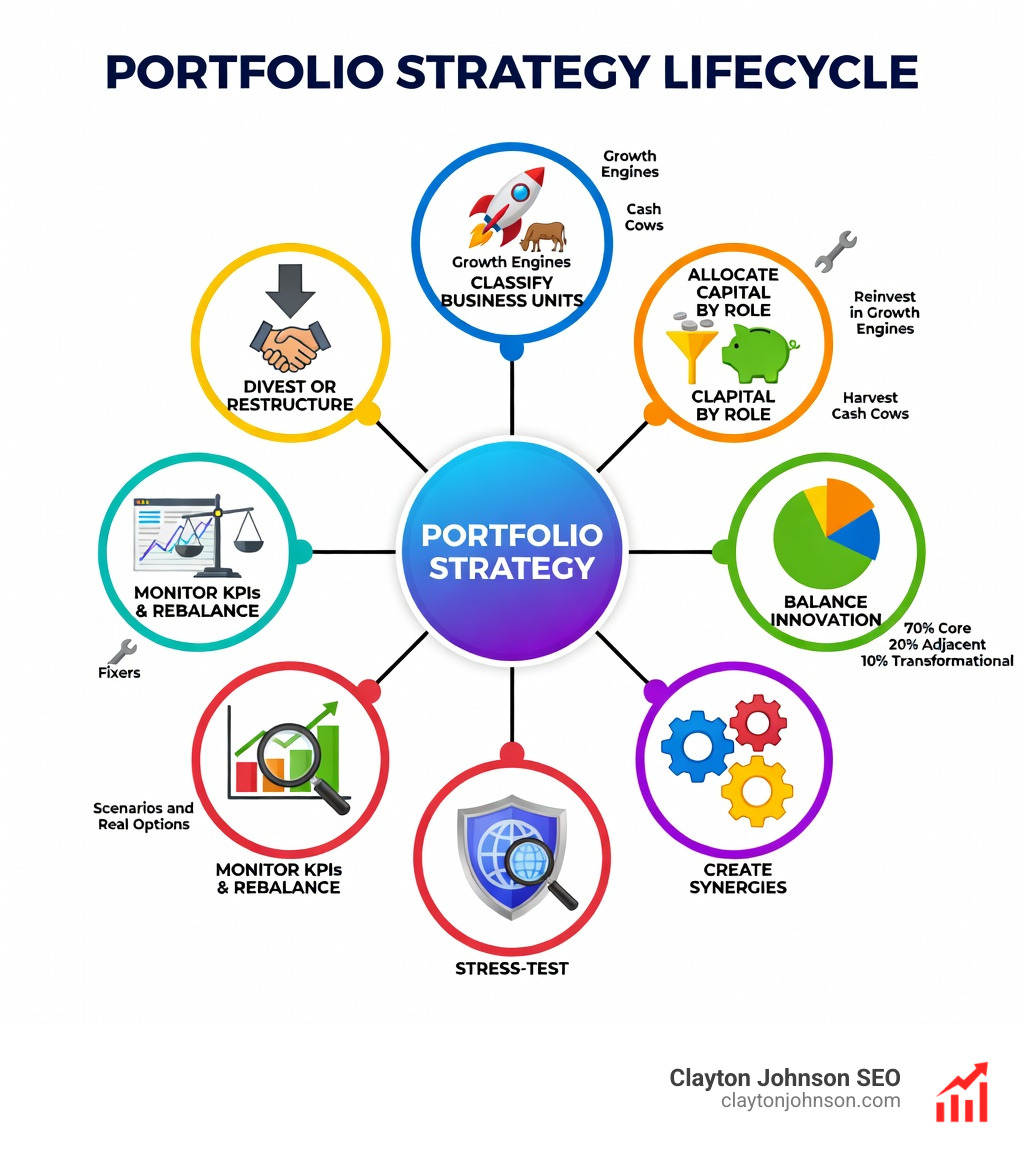

The 7-Step Portfolio Management Process

Managing a portfolio is a continuous loop, not a linear project. Based on proven frameworks used in large-scale government and corporate environments, we follow these seven steps:

- Supply Analysis: Understand the current state. What assets do we have, and how are they actually performing against external benchmarks?

- Portfolio Vision: Facilitate a clear vision with stakeholders. Where do we want to be in 10 years?

- Demand Forecasting: What will the market (the demand) require from us in the future?

- Gap Analysis: Compare the supply (what we have) with the demand (what we need).

- Explore Options: Identify how to close that gap—whether through acquisition, innovation, or divestiture.

- Implementation Plan: Create a detailed 5-year roadmap with clear resource allocations.

- Monitoring and Governance: Regularly report progress against the baseline and adjust as market conditions shift.

Classifying Business Units for Capital Allocation

Not all business units are created equal. If you treat your steady, cash-generating units the same way you treat your high-growth experiments, you’ll likely starve the winners and overfeed the laggards. We use a differentiated approach to assign specific roles to each unit.

| Unit Type | Strategic Role | Reinvestment Rule | Primary KPI |

|---|---|---|---|

| Growth Engines | Future value drivers | High (often >100% of cash flow) | Revenue Growth |

| Cash Cows | Funding the portfolio | Low (usually <50% of cash flow) | Cash Flow Margin |

| Fixers | Turnaround or Exit | Minimal (payback < 2 years) | ROIC Improvement |

As noted in Corporate Portfolio Management: Theory and Practice, top-performing firms link their strategic priorities directly to these capital plans. For example, a “Cash Cow” should be freeing up cash to fund a “Growth Engine.” If it’s hoarding capital for its own “vanity projects,” the entire Portfolio Strategy suffers.

Balancing Innovation in a Portfolio Strategy

Innovation is where most portfolios lose their balance. We advocate for the “Golden Ratio” of innovation investment:

- 70% Core Initiatives: Optimizing existing products and markets.

- 20% Adjacent Efforts: Expanding into related markets or capabilities.

- 10% Transformational Innovation: Creating entirely new breakthrough businesses.

Interestingly, the returns are often the inverse of the investment. Core innovations typically generate 10% of the returns, while transformational bets generate 70%. However, companies that maintain this 70/20/10 balance typically realize a P/E premium of 10% to 20% over their peers. This concept, often viewed as a Strategy as a Portfolio of Real Options, allows you to place small bets today that could become the “Growth Engines” of tomorrow.

Maximizing Value Through Synergies

A portfolio shouldn’t just be a collection of random assets; it should be a “system.” Synergies are the glue that makes the aggregate value greater than the sum of parts. We look for four types of synergies:

- Management Synergies: Applying superior leadership or processes across all units.

- Horizontal Synergies: Sharing resources or customers between business units (e.g., Disney using its movie characters to drive theme park attendance).

- Downward Synergies: The parent company providing low-cost capital or a shared brand.

- Portfolio System Synergies: The unique way the units interact to create a barrier to entry for competitors.

If a business unit has no synergies with the rest of your portfolio, you might not be the “value-maximizing owner.” In those cases, divestiture is often the best strategic move.

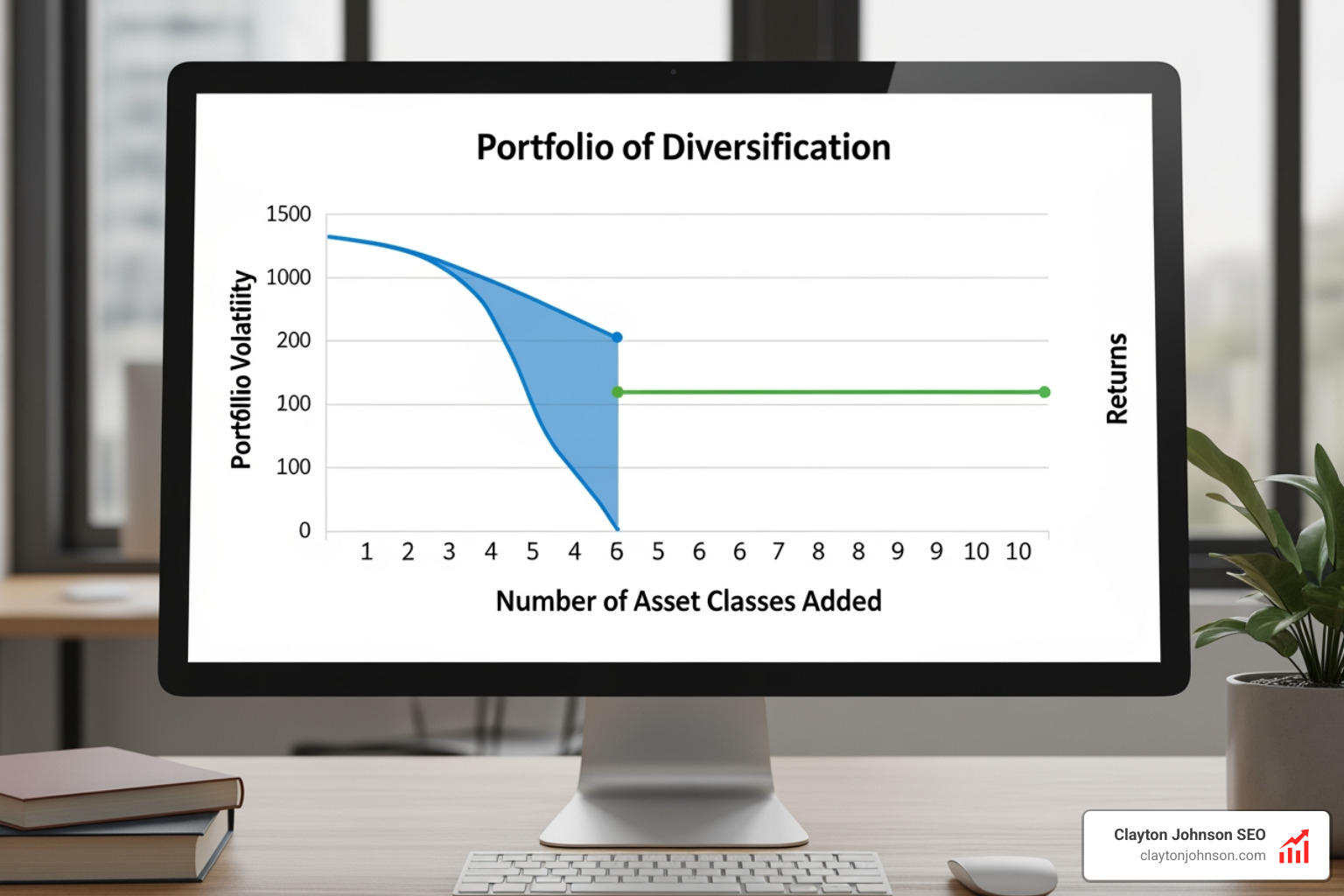

Investment Models for Long-Term Growth

While corporate Portfolio Strategy focuses on business units, the same principles apply to investment portfolios. To grow a nest egg or a corporate treasury, you need a disciplined model.

- Buy and Hold: The simplest strategy. You buy quality assets and hold them through market noise.

- Diversification: Spreading risk across asset classes to reduce the impact of any single failure.

- Dollar-Cost Averaging: Investing a fixed amount regularly, regardless of price, to lower the average cost per share over time.

- CAN SLIM: An active stock-picking system focusing on Current earnings, Annual earnings, New developments, Supply/demand, Leader/laggard status, Institutional sponsorship, and Market direction.

- Dogs of the Dow: A strategy of buying the ten highest-dividend-yielding stocks in the Dow Jones Industrial Average at the start of the year.

According to Vanguard’s Portfolio Construction Framework, asset allocation is the primary driver of long-term returns. It’s not about timing the market; it’s about “time in the market.”

Overcoming Common Pitfalls in Allocation

Even the best-laid plans fail due to human bias. We often see companies fall into these traps:

- Democratic Allocation: Giving everyone an equal slice of the pie to keep the peace. (This is a growth killer).

- Inertia: Allocating the same amount as last year because “that’s how we’ve always done it.”

- Decision Biases: Holding onto a “pet project” or a “legacy business” long after it has stopped creating value.

- Market Timing: Trying to predict the “bottom” or “top” of a cycle. Research shows that 77% of divestiture decisions are delayed by management hesitation, often leading to value erosion.

Differentiating Growth Investment Types

Not all growth investments should be measured with the same yardstick. We categorize them into buckets:

- Short-term Efficiency: Measured by NPV (Net Present Value) and quick payback.

- Strategic Options: Measured by their potential to open new markets. You might accept a lower initial ROI here for a massive future payoff.

- Experimental Bets: Small, stage-gated investments where you “fail fast” or “scale fast.”

Using an interdisciplinary investment committee ensures that talent and capital are allocated to the projects with the highest strategic importance, not just the ones with the loudest advocates.

Building Resilience Through Active Management

In a volatile market, a static Portfolio Strategy is a liability. Resilience comes from active management—constantly refreshing your business mix. Companies that consistently reallocate resources outperform their peers in Total Shareholder Return (TSR) by 3.5% over the long term.

We use Scenario Planning to stress-test your portfolio. What happens if interest rates stay high? What if a new AI competitor emerges? By building “optionality”—the right but not the obligation to take action—you can pivot without destroying value.

McKinsey Portfolio Strategy Insights suggest that the most resilient companies are “dynamic reallocators.” They aren’t afraid to exit an industry if the “owner’s advantage” has disappeared.

Identifying the Right Owner for Assets

The “Right Owner” concept is simple but brutal: An asset is worth more to the person who can generate the most cash from it.

- Intrinsic Value: What is the business worth based on its future cash flows (DCF Analysis)?

- Market Value: What is the stock market currently paying for similar businesses?

If the market value is significantly higher than your intrinsic value—or if another company could run the business more efficiently due to their own synergies—it’s time for a spin-off or a strategic divestiture. P&G and Disney are masters of this, constantly pruning their portfolios to focus on their core competitive advantages.

Monitoring and Implementing the Strategy

A strategy is only as good as its execution. We recommend a 10-year planning horizon with a detailed 5-year implementation schedule. This includes:

- Baseline Progress: Tracking where you started vs. where you are.

- Performance Benchmarks: Comparing your business units against external peers, not just internal history.

- Socio-economic Priorities: Ensuring the portfolio aligns with broader governance and sustainability goals.

- Risk Assessment: Identifying “red flags” early through active monitoring.

Frequently Asked Questions about Portfolio Strategy

What is the difference between portfolio management and portfolio strategy?

Portfolio management is the operational process of managing assets day-to-day (rebalancing, tracking). Portfolio Strategy is the high-level architecture—deciding which businesses to be in, how to allocate capital across them, and how to create synergies between them.

How does the 70/20/10 rule impact innovation returns?

While you spend 70% of your budget on core “safe” bets, they only provide about 10% of your long-term innovation returns. The 10% you spend on “transformational” bets typically generates 70% of the value. The 70/20/10 rule ensures you have the stability to fund the high-stakes winners.

Why is capital allocation considered a strategic lever?

Because it determines your long-term asset base. Where you put your money today dictates what kind of company you will be in five years. It is a much more powerful driver of growth than simple operational improvements.

Conclusion

Designing a Portfolio Strategy that survives market volatility requires a shift from “picking winners” to “building systems.” It’s about creating a structured growth architecture where your cash cows fund your growth engines, and your innovation bets are balanced to ensure long-term survival.

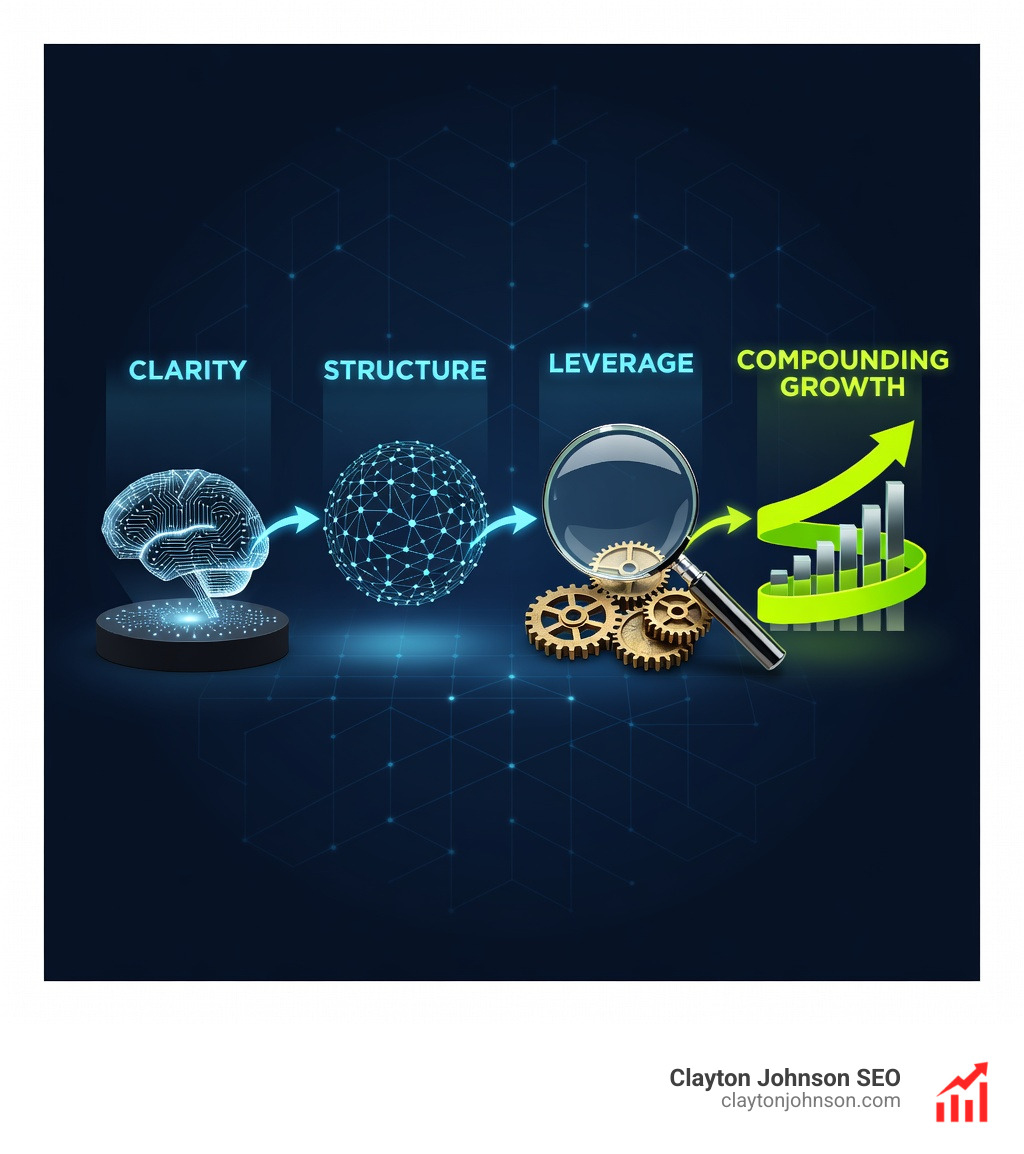

At Clayton Johnson, we believe that clarity leads to structure, and structure leads to compounding growth. Whether you’re managing a corporate portfolio or an SEO content ecosystem, the principles of capital (and resource) allocation remain the same.

Ready to build a more resilient growth engine? More info about portfolio strategy services can help you turn fragmented tactics into a structured, value-creating system.