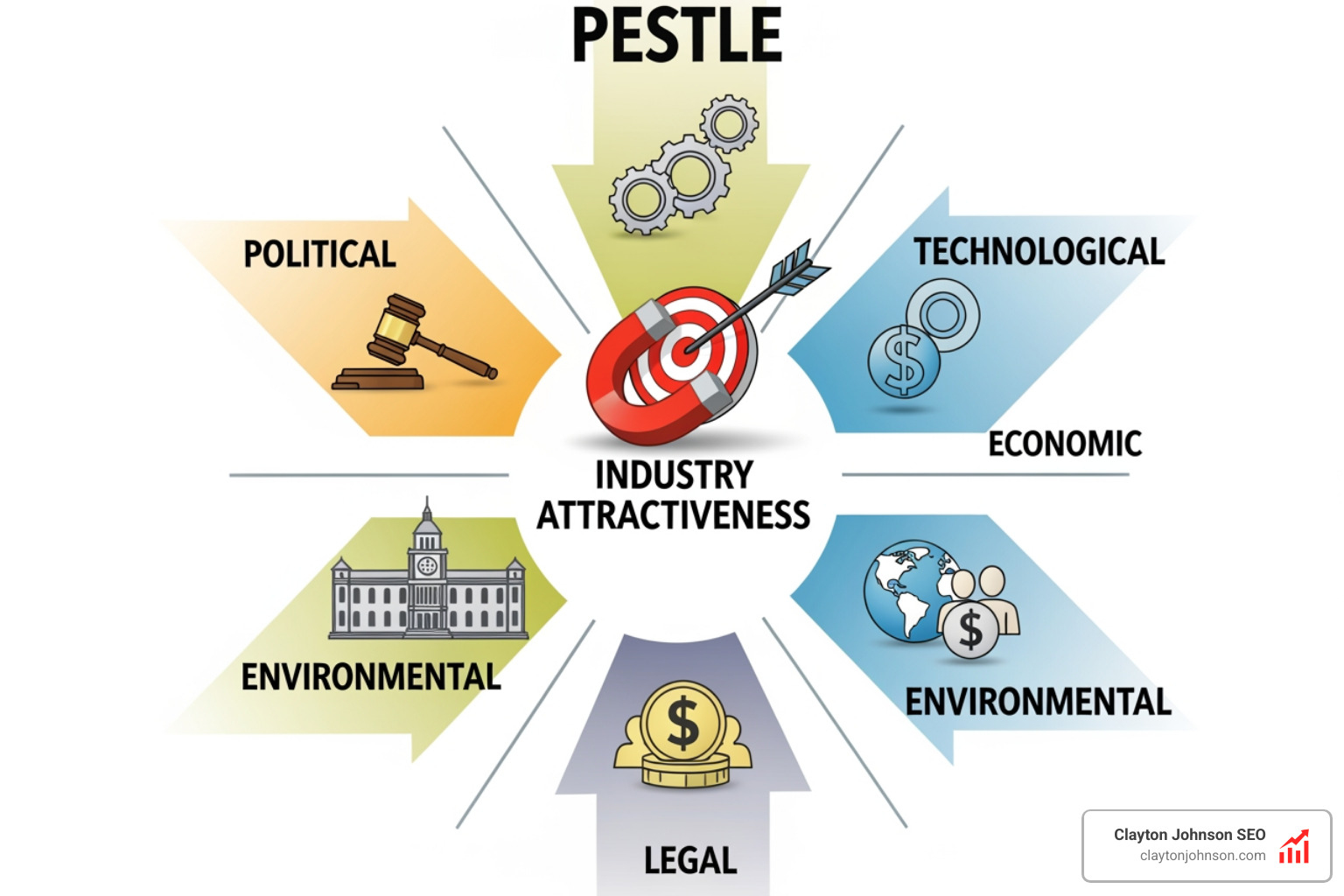

Why Industry Attractiveness PESTLE Factors Matter for Strategic Decisions

Industry attractiveness PESTLE factors are the six external forces—Political, Economic, Social, Technological, Legal, and Environmental—that shape whether an industry offers sustainable growth, profitability, and competitive advantage. Understanding these macro-level influences helps you evaluate market potential, identify emerging threats, and prioritize where to compete before committing resources.

Quick Answer: The Six PESTLE Factors

| Factor | What It Evaluates | Example Impact |

|---|---|---|

| Political | Government policies, stability, trade regulations | Tariffs restricting market access |

| Economic | GDP growth, inflation, exchange rates, consumer spending | Rising interest rates reducing demand |

| Social | Demographics, cultural trends, lifestyle shifts | Aging populations changing product needs |

| Technological | Innovation, automation, digital infrastructure | AI disrupting traditional business models |

| Legal | Employment law, IP rights, compliance requirements | GDPR reshaping data practices |

| Environmental | Climate regulations, sustainability expectations | Carbon taxes increasing operational costs |

Most strategic failures don’t stem from poor execution. They come from entering attractive-looking markets without understanding the macro forces that determine long-term viability.

The global environment changes faster than most businesses can adapt. Companies that once struggled to access market intelligence now drown in conflicting data. Meanwhile, industry attractiveness shifts in ways traditional competitive analysis doesn’t capture—political instability disrupts supply chains, social movements reshape consumer expectations, and technological breakthroughs collapse entry barriers overnight.

PESTLE analysis provides the framework to make sense of these external dynamics. It complements tools like Porter’s Five Forces by examining the broader context in which competitive forces operate. Rather than just analyzing rivals and buyers, you evaluate whether government policies will support or constrain growth, whether economic conditions favor expansion, and whether technological change will strengthen or erode your position.

The research shows measurable consequences when businesses ignore these factors. Fashion production accounts for at least 10% of global carbon emissions—a figure that transforms from statistic to strategic threat when governments impose carbon sanctions. More cars now sell in China than in Europe, fundamentally altering automotive industry attractiveness. The COVID-19 pandemic accelerated digital adoption by several years according to McKinsey, reshaping competitive dynamics across sectors.

I’m Clayton Johnson, and I’ve spent years helping founders and marketing leaders diagnose growth problems by modeling how external forces reshape competitive landscapes—applying industry attractiveness PESTLE factors to separate durable opportunities from temporary trends. This guide breaks down each factor with practical examples, shows how to integrate PESTLE with other frameworks, and provides a step-by-step process for conducting effective macro-environmental analysis.

Decoding Industry Attractiveness PESTLE Factors

When we talk about industry attractiveness, we are essentially asking: “Is this a good neighborhood for our business to move into?” To answer that, we need to uncover and interpret broad, long-term trends that exist outside of our immediate control.

A PESTLE analysis serves as a high-level diagnostic tool. It allows us to audit the external environment to see if the wind is at our back or if we’re heading into a storm. By examining these six specific lenses, we can determine the market potential and long-term viability of an industry. This isn’t just about avoiding risks; it’s about finding a competitive advantage by spotting opportunities that others miss because they are too focused on their internal operations.

Evaluating Political and Legal Industry Attractiveness PESTLE Factors

Politics and law are two sides of the same coin. They represent the “rules of the game.”

On the political side, we look at how government policy impacts the economy or specific sectors. A government might impose a new tax or duty that completely alters how an organization generates revenue. For instance, in our home base of Minneapolis, Minnesota, local manufacturing sectors often keep a close eye on trade policies and state-level incentives that can either accelerate growth or create bottlenecks.

Political stability is also a major driver of industry attractiveness. If a country or region is prone to sudden leadership changes or civil unrest, the risk of doing business there skyrockets.

The legal factor is more granular. It focuses on the specific regulations we must follow. Key areas include:

- Employment Law: Changes in minimum wage or labor rights (like the yearly increases in the National Minimum Wage in various regions) directly affect profitability.

- Data Privacy: Regulations like the EU’s GDPR have fundamentally changed how tech and marketing industries operate globally.

- Intellectual Property (IP) Rights: If an industry doesn’t have strong IP protections, it becomes much less attractive for innovation-heavy companies.

- Health and Safety: Stringent regulations can increase costs but also protect an industry from catastrophic reputational damage.

Economic and Social Influences on Market Potential

Economic factors are often the most visible. We have to consider exchange rates, inflation, and interest rates. For example, high inflation can destabilize an economy, making it nearly impossible for a business to predict future costs or set prices effectively. Conversely, low exchange rates might reduce the threat from foreign competitors, making a domestic industry more attractive.

In Minnesota, we see these economic variables play out in our manufacturing and agricultural sectors. The growth of the “gig economy” is another economic shift, altering labor markets and how services are delivered.

Social factors, however, are often the “silent” drivers of change. They involve cultural trends, demographics, and population statistics. Consider these shifts:

- Demographics: An aging population in the West creates massive opportunities in healthcare but may signal a decline in industries aimed at younger consumers.

- Lifestyle Shifts: The rising “coffee culture” has transformed the beverage industry, while a growing focus on health and wellness has decreased demand for tobacco.

- Global Markets: China’s 1.3 billion people represent a massive, largely untapped consumer market. Today, more cars are sold in China than in Europe, which has forced the entire automotive industry to pivot its strategy eastward.

Social factors can be harder to quantify than a GDP growth rate, but they are just as vital. They dictate when and why people buy. For example, religious holidays like Ramadan or the Western holiday season create predictable but intense spikes in consumer spending that industries must prepare for.

Reshaping Barriers: Technological and Environmental Shifts

In the modern era, technology and the environment are the two factors moving the needle most aggressively. They don’t just influence industries; they reshape the very barriers to entry that keep competitors at bay.

Technological Advancements and R&D

Technological factors include R&D investment, automation, and the diffusion of new scientific advances. In the past, high entry barriers often protected established players. Today, disruptive technologies—like smartphones, AI, and blockchain—allow lean startups to compete with global giants.

A recent Investigation of PESTEL factors driving change highlights how digital transformation is no longer optional. If your industry’s technology isn’t “fit for purpose,” you are essentially a sitting duck for more agile competitors.

Environmental and Sustainability Trends

Environmental factors have moved from “nice-to-have” CSR initiatives to core business requirements. We now see:

- Carbon Emissions: With fashion production responsible for at least 10% of humanity’s carbon emissions, the pressure to go green is immense.

- Renewable Energy: The move toward wind turbines and solar panels is creating entirely new industries while making traditional fossil-fuel-dependent sectors less attractive to investors.

- Circular Economy: Industries that embrace recycling and sustainable resources are finding favor with both regulators and consumers.

Modernizing Industry Attractiveness PESTLE Factors for the Digital Era

The digital era has added a layer of complexity to traditional PESTLE analysis. We are no longer just looking at “technology” as a single bucket; we are looking at a digital ecosystem.

- AI Personalization: Gartner predicts that more than 30% of public-facing websites will have integrated real-time AI personalization. This raises the bar for what consumers expect from every industry.

- The Gig Economy: Digital platforms have fundamentally changed labor costs and worker availability.

- Cybersecurity: As industries move to the cloud, the legal and technological risk of data breaches becomes a primary concern for industry viability.

- Digital Divide: While some markets are hyper-connected, others lack the infrastructure, creating a “digital divide” that businesses must navigate when planning international expansion.

To stay ahead, we offer SEO content marketing services that help businesses navigate these shifting digital landscapes by building authority in their respective niches.

Real-World Examples of Industry Success and Decline

Let’s look at how these industry attractiveness PESTLE factors manifest in reality:

- The Automotive Industry: The shift toward environmental consciousness and technological innovation (EVs) has made traditional internal combustion engine manufacturing less attractive. Meanwhile, China’s massive consumer base has made it the primary battleground for growth.

- Retail and Ethical Sourcing: Many retail brands have found that implementing ethical sourcing policies improves customer relationships, even if it increases short-term costs. However, failing to adapt to the “work-from-home” social shift has led to the decline of many city-center shopping malls.

- Data Centers: This is a booming industry, but it faces a major “P” and “S” challenge: labor shortages. In places like Japan and even parts of the US, immigration policies and a lack of skilled labor have created bottlenecks in development.

- The COVID-19 Pandemic: This was a massive external shock that accelerated digital adoption by several years. Industries that were “digital-ready” thrived, while those reliant on physical presence had to undergo painful transformations.

Strategic Integration: PESTLE, SWOT, and Porter’s Five Forces

PESTLE is powerful, but it shouldn’t live in a vacuum. To get a truly comprehensive view of industry attractiveness, we need to integrate it with other frameworks.

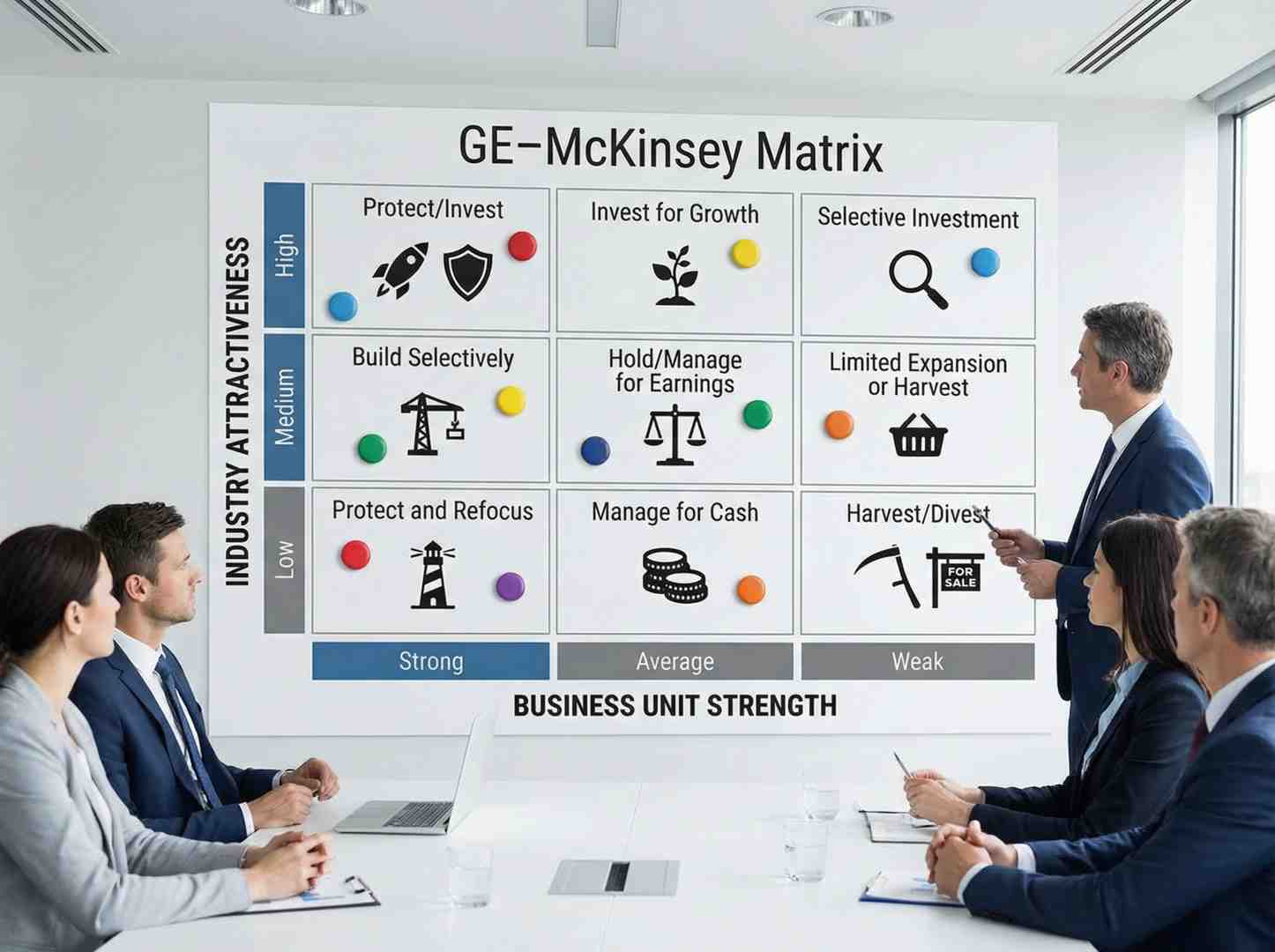

PESTLE vs. Porter’s Five Forces

While PESTLE looks at the “Macro” environment (the big picture), Porter’s Five Forces looks at the “Micro” environment (the industry specifics).

| Framework | Focus | Key Questions |

|---|---|---|

| PESTLE | Macro-Environment | How do global trends affect the industry? |

| Porter’s Five Forces | Industry Structure | How intense is the competition within the industry? |

| SWOT | Internal/External Link | How do our internal strengths match external opportunities? |

By combining these, we can identify risks more effectively. For example, a PESTLE analysis might show a favorable political environment for renewable energy, while Porter’s Five Forces might show that the industry is already overcrowded with high buyer power, making it less attractive than it first appeared.

At Clayton Johnson, we focus on conversion optimization services to help businesses capitalize on the opportunities identified through these strategic frameworks.

How to Conduct an Effective Industry Evaluation

Conducting a PESTLE analysis isn’t just a “one and done” brainstorming session. It requires a structured approach to ensure you don’t miss the details that actually matter.

- Brainstorm: Gather a diverse team—including front-line staff—to identify factors in each of the six categories.

- Investigate: Don’t rely on gut feelings. Use data-driven research. Look at GDP forecasts, demographic shifts, and legislative pipelines.

- Rate Significance: Not every factor is equally important. Rate each one based on its potential impact on your business and the likelihood of it occurring.

- Collaborate: Share the findings with stakeholders to gain a deeper view and find hidden risks.

- Strategize: Use the insights to prioritize market entry or exit. If the macro-trends are overwhelmingly negative, it may be time to pivot.

- Monitor: The business environment is dynamic. Set up a schedule for ongoing monitoring of these factors.

We provide analytics and data services to help businesses turn these raw observations into actionable growth models.

Common Pitfalls to Avoid in Macro-Analysis

Even the best teams can stumble when applying PESTLE. Here are the most common traps:

- Overlooking Local Details: It’s easy to get caught up in “mega-trends” and forget about the local factors that directly affect your product. In Minneapolis, local zoning laws or state taxes can be more impactful than global trade agreements.

- “Solution Mode” Bias: Many teams start trying to solve problems before they’ve fully identified them. Stay in “identification mode” during the initial phases.

- Ignoring Front-Line Insights: Senior management often misses emerging threats that front-line employees see every day.

- Static Analysis: Treating PESTLE as a static document is a mistake. It must be a living part of your strategic foresight.

- Unspoken Threats: Sometimes the biggest risks are the ones everyone knows about but no one wants to mention. Create a safe space for “unspoken threats” to be voiced.

Frequently Asked Questions about Industry Attractiveness

How does PESTLE differ from SWOT analysis?

PESTLE focuses entirely on the external macro-environment—things you cannot control but must respond to. SWOT includes internal factors (Strengths and Weaknesses) as well as external ones (Opportunities and Threats). PESTLE is often used as a precursor to SWOT to help identify the “O” and “T” sections.

What are the most common pitfalls in PESTLE analysis?

The most common pitfalls include being too generic, failing to update the analysis regularly, and suffering from “confirmation bias” (only looking for data that supports your existing strategy).

Which PESTLE factor is most important for modern tech industries?

While all are important, Technological and Legal factors currently dominate the tech landscape. Rapid innovation (AI) and increasing regulation (GDPR, antitrust laws) are the primary drivers of industry attractiveness in the digital space.

Conclusion

Understanding industry attractiveness PESTLE factors is the difference between strategic gambling and structured growth. By auditing the external environment across political, economic, social, technological, legal, and environmental lenses, we can see through the noise and identify where the real opportunities lie.

At Clayton Johnson, we are building Demandflow.ai to provide founders and marketing leaders with the structured growth architecture they need to thrive. We believe that clarity leads to structure, and structure leads to compounding growth. Whether you need a taxonomy-driven SEO system or a comprehensive competitive positioning model, we are here to help you build a sustainable authority-building ecosystem.

Ready to stop guessing and start growing? Work with me to implement a strategic framework that turns macro-trends into your competitive advantage.