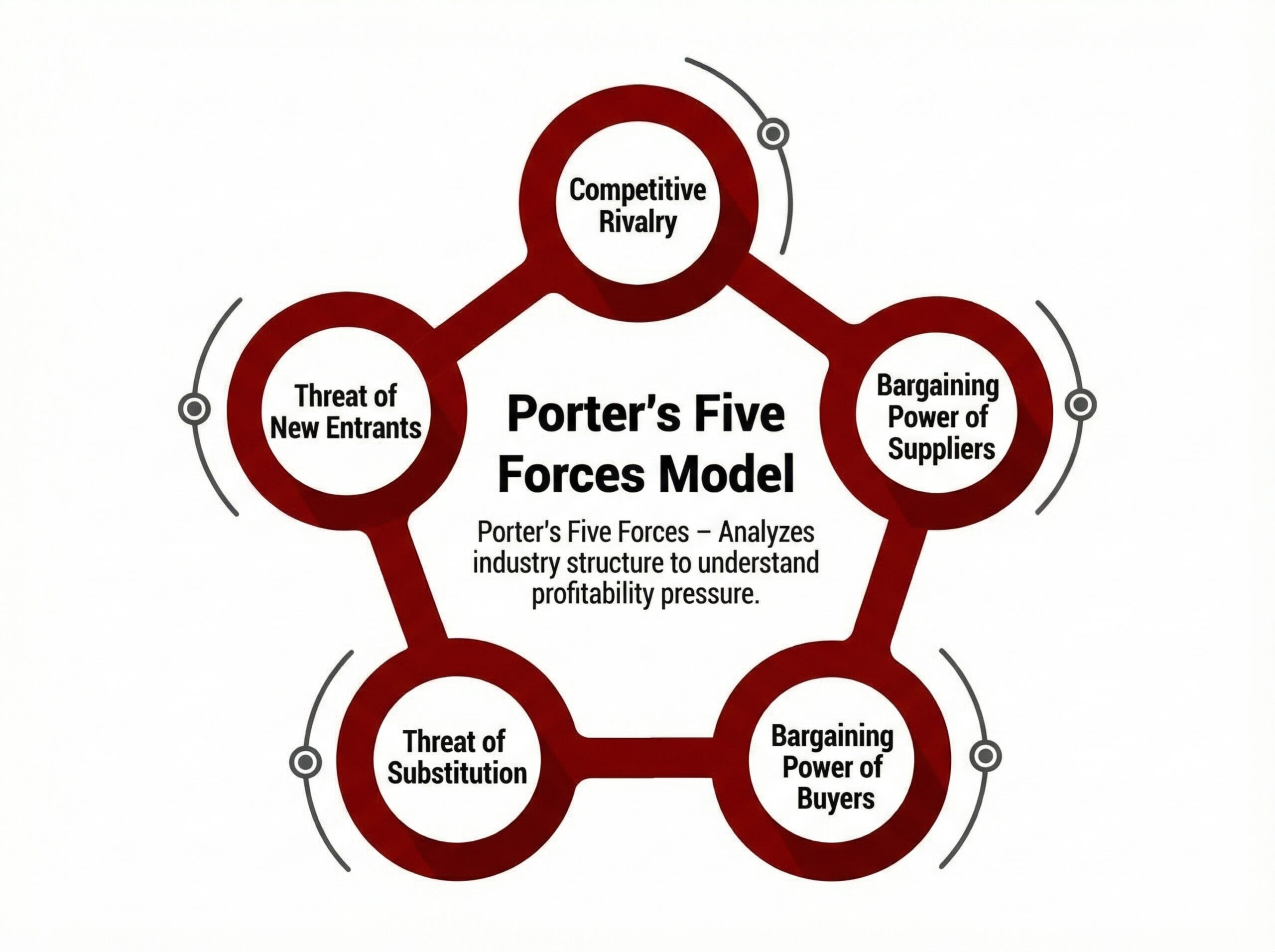

🧭 OVERVIEW

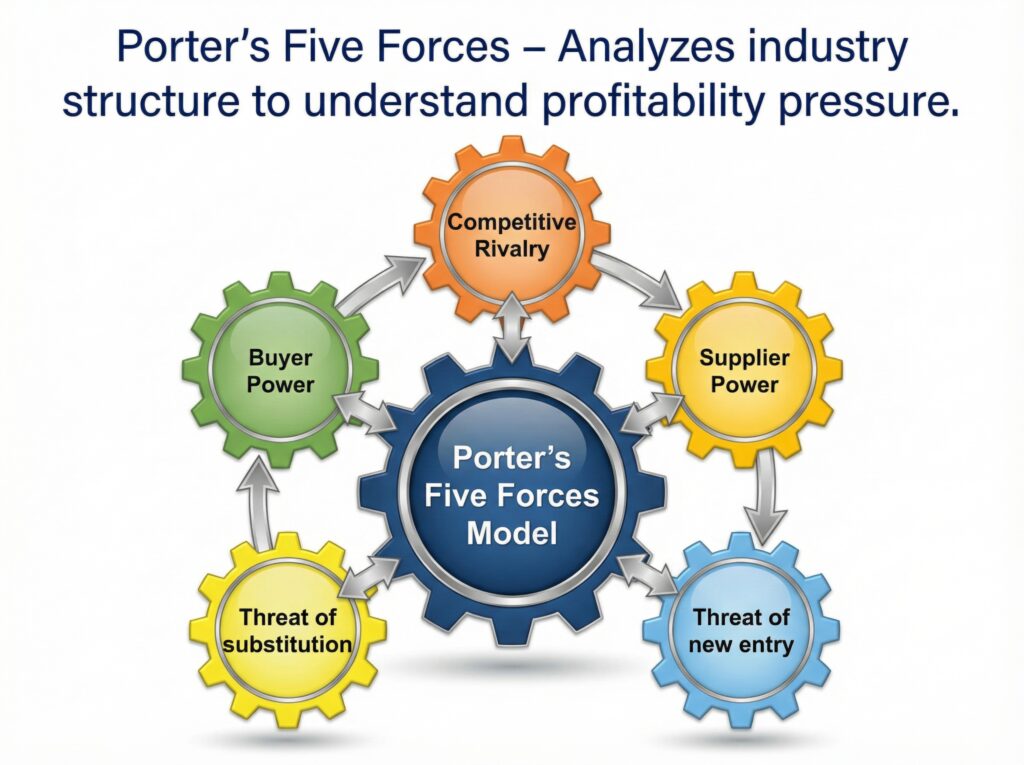

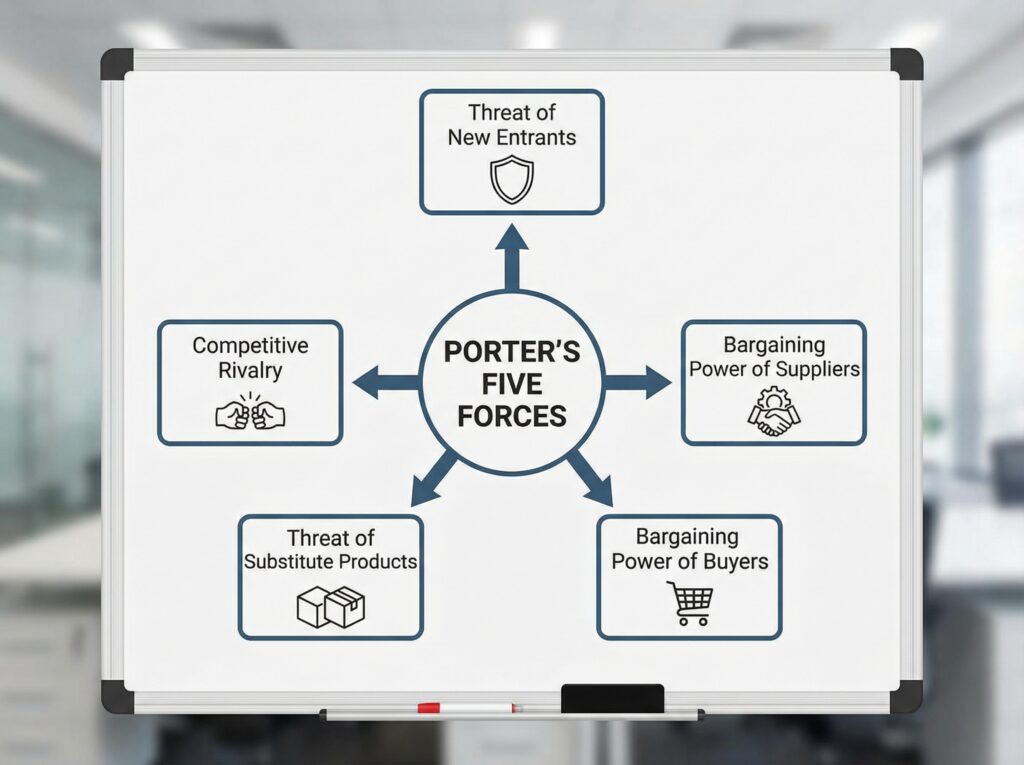

Porter’s Five Forces is an industry structure analysis framework used to understand competitive pressure and long-term profitability.

It explains why some industries are structurally attractive—and others aren’t—regardless of how good individual companies are.

It examines five forces that determine how value is created and captured within an industry.

WHAT IS PORTER’S FIVE FORCES?

An industry-level model that evaluates competitive intensity and margin pressure by analyzing:

- Competitive Rivalry

- Buyer Power

- Supplier Power

- Threat of Substitutes

- Threat of New Entrants

Its purpose is to:

- assess industry attractiveness

- anticipate margin pressure

- guide positioning and strategic choices

- explain why execution alone may not win

🧱 THE FIVE FORCES FRAMEWORK

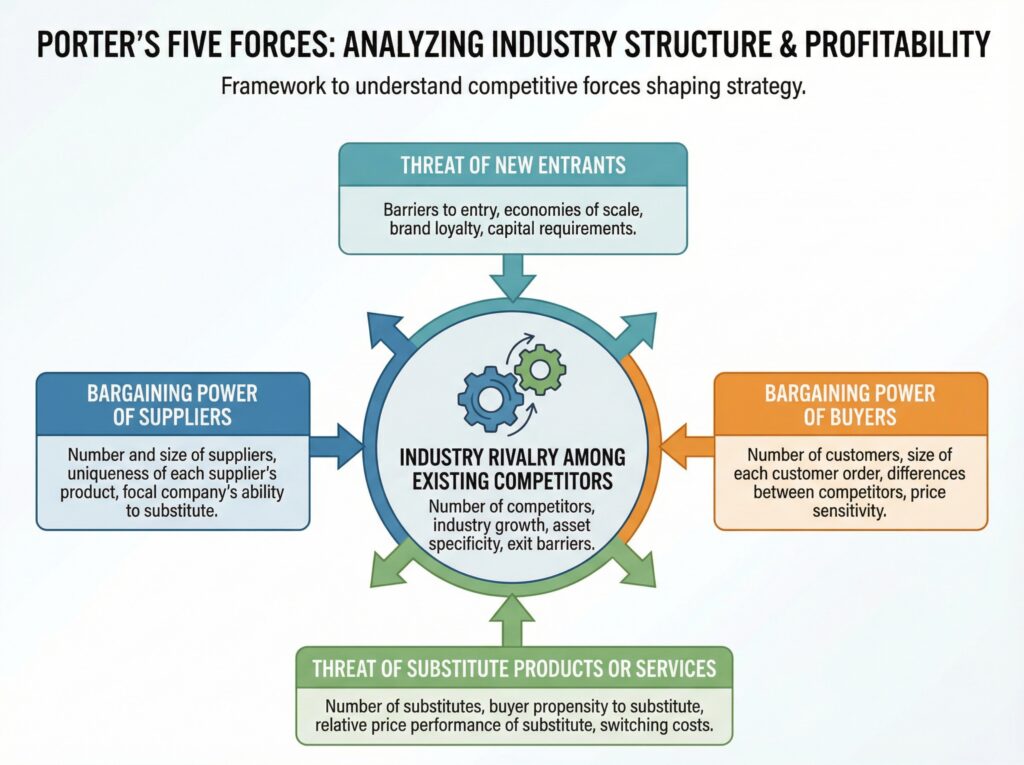

⚔️ 1. COMPETITIVE RIVALRY

Definition: Intensity of competition among existing players.

Key Drivers

- Number and size balance of competitors

- Industry growth rate

- Product differentiation

- Exit barriers (fixed assets, regulation, contracts)

Real-World Impact

- High rivalry → price wars, marketing escalation, margin erosion

- Low rivalry → pricing power and stability

Research Signals

- Market share concentration (HHI)

- Industry growth rates

- Pricing behavior over time

Example

Airlines compete heavily on price with low differentiation → chronic low margins.

🧍 2. BUYER POWER

Definition: Customers’ ability to demand lower prices or higher value.

Key Drivers

- Buyer concentration vs sellers

- Switching costs

- Price sensitivity

- Availability of alternatives

Real-World Impact

- High buyer power → margin compression

- Low buyer power → pricing leverage

Research Signals

- Contract structures

- Customer churn rates

- Procurement sophistication

Example

Large retailers (e.g., Walmart) exert pricing pressure on suppliers.

🏭 3. SUPPLIER POWER

Definition: Suppliers’ ability to raise prices or reduce quality.

Key Drivers

- Supplier concentration

- Uniqueness of inputs

- Switching costs

- Threat of forward integration

Real-World Impact

- High supplier power → cost volatility

- Low supplier power → input stability

Research Signals

- Input cost trends

- Supply chain concentration

- Dependency ratios

Example

Chip shortages increased supplier power over automakers.

🔁 4. THREAT OF SUBSTITUTES

Definition: Availability of alternative solutions that satisfy the same need.

Key Drivers

- Price-performance tradeoffs

- Switching costs

- Buyer willingness to substitute

Real-World Impact

- Strong substitutes cap pricing

- Weak substitutes allow premium positioning

Research Signals

- Cross-industry comparisons

- Customer behavior under price changes

Example

Video conferencing substitutes business travel.

🚪 5. THREAT OF NEW ENTRANTS

Definition: Ease with which new competitors can enter the market.

Key Drivers

- Capital requirements

- Economies of scale

- Regulation and licensing

- Brand loyalty and network effects

Real-World Impact

- Low barriers → constant margin pressure

- High barriers → protected profits

Research Signals

- Startup activity

- VC investment patterns

- Regulatory hurdles

Example

Banking has high entry barriers due to regulation and capital requirements.

📋 HOW TO RUN A FIVE FORCES ANALYSIS

| Step | Description |

|---|---|

| 1 | Define the industry boundary clearly |

| 2 | Assess strength of each force (Low / Medium / High) |

| 3 | Identify which forces dominate profitability |

| 4 | Link forces to margin, pricing, and growth |

| 5 | Identify strategic levers to weaken forces |

🎯 STRATEGIC INTERPRETATION

Strong forces = structurally unattractive industry

Weak forces = opportunity for sustained returns

The goal is not to win within the forces, but to:

- position against them

- reshape them

- or escape them entirely

🔗 FIVE FORCES → STRATEGY MAPPING

| Dominant Force | Strategic Response |

|---|---|

| High Rivalry | Differentiate or niche down |

| High Buyer Power | Increase switching costs |

| High Supplier Power | Vertical integration or diversification |

| Strong Substitutes | Redefine value proposition |

| High Entry Threat | Build scale, brand, or network effects |

⚠️ LIMITATIONS & COMMON PITFALLS

| Risk | Description | Avoidance |

|---|---|---|

| Static View | Ignores change over time | Pair with PESTLE |

| Overgeneralization | Poor industry definition | Narrow scope carefully |

| Strategy Confusion | Analysis ≠ decision | Follow with positioning frameworks |

| Firm-Level Misuse | Not a company analysis | Use VRIO for internal view |

🧠 FINAL INSIGHTS

- Five Forces explains why profits exist, not how to execute

- Industry structure matters more than short-term tactics

- Competitive advantage often comes from changing the forces, not fighting them

- Best used before choosing a strategy

✅ YOU ARE NOW READY TO:

- Assess industry attractiveness

- Explain margin pressure to stakeholders

- Inform positioning and investment decisions

- Pair with PESTLE, Generic Strategies, and Market Attractiveness models