Competitive Analysis is the systematic process of evaluating your rivals’ strengths, weaknesses, strategies, and market positioning — so you can make smarter decisions and grow faster.

Here’s what it covers at a glance:

| What You Analyze | Why It Matters |

|---|---|

| Direct, indirect & substitute competitors | Understand the full competitive landscape |

| Pricing, products & marketing | Spot gaps and opportunities |

| Strengths & weaknesses | Know where you can win |

| Customer sentiment & reviews | Find unmet needs |

| SEO, social & content strategy | Identify channels to outperform |

Most businesses skip this — or do it once and forget it. Research shows most firms rely on “informal impressions, conjectures, and intuition” instead of systematic analysis. That’s a dangerous blindspot in a market that never stops moving.

The good news? A structured competitive analysis gives you both an offensive and defensive edge. You’ll see where competitors are vulnerable, where your positioning can improve, and what moves to make before the market forces your hand.

I’m Clayton Johnson, an SEO and growth strategist who has built competitive intelligence systems for founders and marketing leaders across dozens of business models — and competitive analysis is one of the core pillars I use to build strategies that compound over time. Let’s break down exactly how to do it right.

Why Competitive Analysis is the Backbone of Business Strategy

In high-stakes business, flying blind is a choice—and usually a bad one. A Market Analysis that ignores the specific moves of your rivals is just a wish list. To win, we need strategic context.

According to the Competitive Analysis Definition, this process is an assessment of your competitors’ products, services, and sales tactics. It provides the “why” behind your market’s behavior. Without it, you fall victim to competitive blindspots—those dangerous areas where a rival is quietly eating your lunch while you’re busy looking at your own navel.

Offensive vs. Defensive Strategy

A systematic Competitive Analysis serves two primary masters:

- Offensive Strategy: Identifying a rival’s weakness (like a gap in their service or a high-priced product) and attacking it with a better, faster, or cheaper version.

- Defensive Strategy: Anticipating a competitor’s move—like a new product launch or a price cut—and preparing your counter-move before they steal your market share.

By understanding How to Think About Competitive Pressure, we move from being reactive to proactive. We don’t just wait for market saturation to hit us; we see it coming and pivot our growth strategy accordingly.

Identifying Your Rivals: Direct, Indirect, and Substitute Competitors

One of the biggest mistakes we see founders make is defining their competition too narrowly. If you only look at people who do exactly what you do, you’re going to get blindsided by a substitute you never saw coming.

To build a complete Market, Industry, and Competitive Analysis, we categorize rivals into three distinct groups:

1. Direct Competitors (Brand Competitors)

These are the “Hatfields to your McCoys.” They offer similar products to the same target audience. If you sell CRM software to mid-sized tech companies, another CRM company selling to that same segment is a direct competitor. You can use NAICS codes (the North American Industry Classification System) to find industry benchmarks and identify these players systematically.

2. Indirect Competitors (Product/Industry Competitors)

These rivals fulfill the same customer need but with a different product. For example, a high-end gym and a fitness app are indirect competitors. They both solve the “I want to be fit” problem, but their delivery methods differ.

3. Substitute Competitors (Generic Competition)

This is the most overlooked category. A substitute is anything a customer might use instead of your category entirely. For instance, during the pandemic, home nail kits became a major substitute for professional nail salons. As noted in Competitor Identification and Analysis, we must look at “substitution-in-use”—the various ways a customer might solve their problem in a specific usage situation.

By mapping out these strategic groups, we can see the full board. You aren’t just competing against other brands; you’re competing for a “share of heart” and a “share of mind” in the customer’s life.

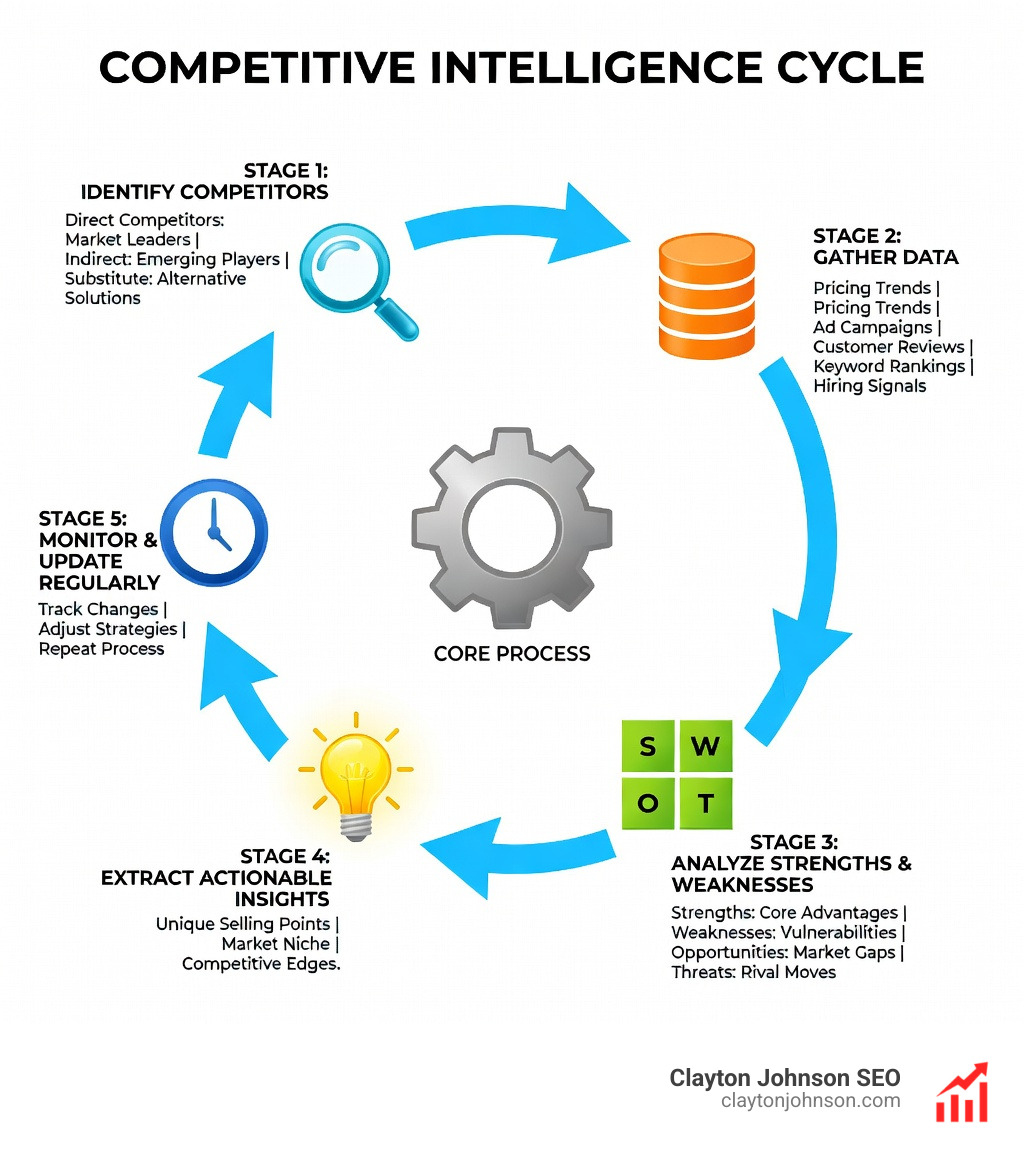

The Step-by-Step Guide to Conducting a Competitive Analysis

Conducting a Competitive Analysis isn’t a weekend hobby; it’s an organizational discipline. Here is how we recommend you handle the process to ensure you aren’t just collecting “informal impressions.”

- Identify the Players: Use search engines, industry reports, and customer feedback to list your top 5-10 rivals across the direct and indirect categories.

- The 4 Ps Audit: Analyze their Marketing Mix—Product (features/quality), Price (discounts/tiers), Place (distribution channels), and Promotion (advertising/SEO).

- Revenue and Business Models: How do they make money? Is it subscription-based, one-time, or freemium?

- Content and SEO: Use tools like a Competitive Content Gap Finder to see which keywords they rank for that you don’t. This is often where the most immediate “low-hanging fruit” for growth lives.

For a deeper dive, check out this guide on How to Conduct a Business Competitor Analysis.

Gathering Data for Your Competitive Analysis

The data is out there—you just have to know where to dig. To go beyond surface-level metrics, we look at:

- Social Media & Customer Reviews: Scrape sites like Reddit, G2, or Capterra. What are people complaining about? Those complaints are your roadmap for differentiation.

- Help Centers & Documentation: Reverse-engineer their product by looking at their help docs. It reveals their feature depth and the specific problems they are trying to solve for users.

- Job Postings: If a competitor is suddenly hiring five AI engineers, you know exactly where their product roadmap is heading.

- Google Alerts: Set these up for competitor brand names to get real-time news on their partnerships or crises.

We also advocate Using AI Competitive Insights to Outsmart Your Rivals. AI can synthesize thousands of reviews into a sentiment report in seconds, giving you a massive head start.

Building a Competitive Analysis Matrix

Once you have the data, you need to organize it. A Competitor Array or matrix allows you to compare “apples to apples.”

| Feature/Factor | Your Brand | Competitor A | Competitor B | Weighting |

|---|---|---|---|---|

| Pricing | $49/mo | $59/mo | $39/mo | 0.30 |

| Ease of Use | 9/10 | 6/10 | 8/10 | 0.25 |

| Feature Depth | 7/10 | 9/10 | 5/10 | 0.25 |

| Customer Support | 10/10 | 5/10 | 7/10 | 0.20 |

| Total Score | 8.65 | 7.45 | 6.70 | 1.00 |

This systematic approach, as detailed in Competitor analysis, helps you identify your Points of Parity (where you must match them to stay in the game) and your Points of Difference (where you can actually win).

Essential Frameworks for Organizing Competitor Intelligence

Data without a framework is just noise. To turn your research into strategy, we use these classic models:

- SWOT Analysis: The bread and butter of strategy. Map out the Strengths, Weaknesses, Opportunities, and Threats for yourself and your top three rivals.

- Porter’s Five Forces: This looks at the broader industry structure—the threat of new entrants, the power of suppliers/buyers, and the threat of substitutes. It helps you understand if a market is even worth competing in.

- PESTLE Analysis: Analyzes external factors (Political, Economic, Social, Technological, Legal, Environmental) that might affect the entire competitive landscape.

- Strategy Canvas: A tool for Visualizing Your Competitive Edge with a Strategy Canvas by plotting value dimensions against your rivals.

- BCG Matrix: Helps you decide which products in your portfolio are “Stars,” “Cash Cows,” “Question Marks,” or “Dogs” based on market growth and share.

By learning How to Master the 5 Forces of Competition, you ensure your strategy is rooted in the reality of the market, not just internal optimism.

Turning Insights into Actionable Growth Strategies

Now for the most important part: What do you actually do with this information? The goal of Competitive Analysis isn’t to create a pretty PDF; it’s to build Growth Systems.

Differentiation and Unfair Advantages

Use your insights to find your “Unfair Advantage.” This could be deep domain expertise, a unique patent, or a superior distribution channel. If you find that every competitor is focusing on “Enterprise” features but ignoring the “Small Business” segment, that’s your opening.

Response Profiles & Market Attacks

How will your rivals react when you move?

- Frontal Attack: Matching the competitor’s product, price, and promotion. (Risky and expensive).

- Flank Attack: Attacking the competitor’s weak spots or underserved segments.

- Guerrilla Warfare: Small, intermittent attacks to harass and demoralize the competitor.

As noted in Strategic Planning for Distributors, having detailed profiles on each major competitor allows you to predict their “Response Profile” and maintain strategic agility.

Avoiding Common Pitfalls in Competitive Analysis

Even the best strategists can fall into traps. Here is what to watch out for:

- Over-fixation: Don’t spend so much time watching your rivals that you forget to innovate. You want to be a market leader, not a professional follower.

- Relying on Outdated Data: Markets move fast. An analysis from two years ago is a historical document, not a strategy.

- Copying: The goal is to differentiate, not to become a “lite” version of your biggest rival.

- Analysis Paralysis: Don’t get stuck in the data. Collect enough to make an informed decision, then execute.

We recommend learning How to Score Your Brand with AI-Powered Competitive Analysis to speed up the process and avoid strategic myopia (narrow-mindedness).

Frequently Asked Questions about Competitive Analysis

How often should I update my competitive analysis?

At a minimum, you should conduct a full Competitive Analysis once a year. However, in fast-moving industries like SaaS or E-commerce, we recommend a “light” refresh every quarter and setting up real-time monitoring for major moves.

What is the difference between direct and indirect competitors?

Direct competitors offer a similar product to the same audience (e.g., Coca-Cola vs. Pepsi). Indirect competitors offer a different product that solves the same problem (e.g., Coca-Cola vs. a local coffee shop).

What are the best tools for gathering competitor intelligence?

For SEO and digital marketing, Ahrefs and SEMrush are industry standards. For company data and funding, Crunchbase is invaluable. For social listening and sentiment, tools like Brandwatch or even simple Google Alerts can provide a wealth of information.

Conclusion

At the end of the day, Competitive Analysis is about one thing: Leverage. When you understand the board, you can move your pieces with confidence. You stop guessing and start growing.

At Demandflow.ai, we believe that most companies don’t lack tactics—they lack structured growth architecture. We build the systems that turn competitive intelligence into compounding growth. Whether you are in Minneapolis or scaling globally, your success depends on your ability to out-think and out-position the competition.

Ready to stop letting your rivals win? Master your strategy with our Competitive Analysis framework and start building your unfair advantage today.